China Buys Gold, Gold Price Sinks!

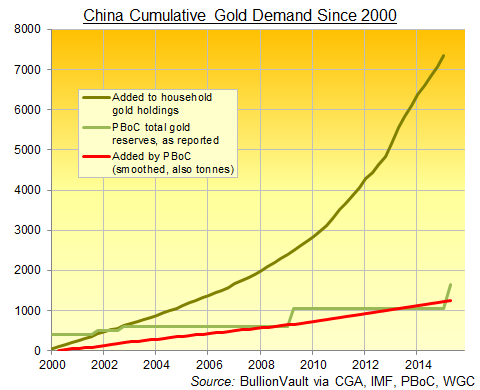

"The capacity of the gold market is small compared with the scale of China's foreign exchange reserves. A large number of short-term transactions to buy gold could easily affect the market."

"If China purchases gold on a large scale, prices on the international market price will surge, which would, in turn, affect domestic individual consumers."

"As it is, China has already become the world's largest gold producer, and is also a big consumer of gold, with an on-going policy of encouraging gold ownership by private individuals. It's important to continue and consider the future of private investment demand as well as keeping international reserve asset allocation a flexible operation."

Email us

Email us