Gold Steady as Traders Eye Ukraine Peace Talks and Powell’s Jackson Hole Speech

GOLD PRICES rose Monday lunchtime as traders focused on the meeting between Ukraine’s President Volodymyr Zelenskyy and US President Donald Trump in Washington, as well as the annual Jackson Hole Economic Policy Symposium, where Federal Reserve Chair Jerome Powell is scheduled to speak on Friday, writes Atsuko Whitehouse at BullionVault.

President Zelenskyy and European leaders are scheduled to arrive in Washington today to learn what Trump had negotiated at what he described as a “high-stakes” summit with Russian President Vladimir Putin in Alaska last Friday.

With no FOMC meeting scheduled in August, market participants are also turning their attention to Powell’s upcoming remarks at the Jackson Hole Symposium, a gathering of central bank officials and economists from around the world held in Wyoming.

At the 2024 Jackson Hole Symposium, Powell stated that “the time has come” and signalled that interest rates would be cut at the September meeting.

Spot gold rose 0.4% to $3348 per ounce, while ten-year US Treasury yields - a benchmark for government, financial, and commercial borrowing costs - slipped 2 basis points from their two-week high.

This followed the yellow metal’s weekly decline last week, after stronger-than-expected US inflation data reduced expectations for Federal Reserve rate cuts.

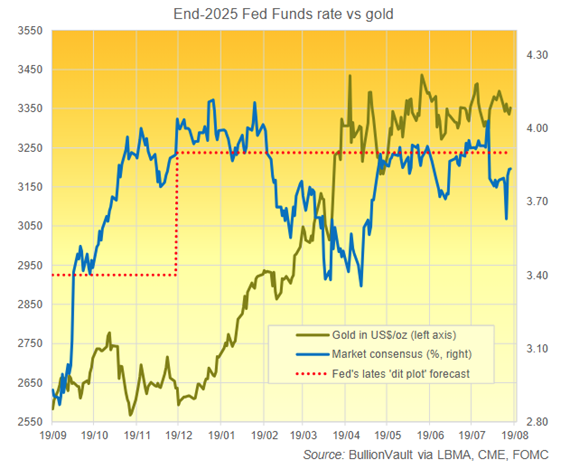

Market consensus on Monday projected that Fed rates would end 2025 at 3.82% - nearly 20 basis points above the level forecast last Wednesday, but still consistent with the Federal Open Market Committee (FOMC) expectation of two additional cuts before year-end.

Data released last Thursday showed that US producer prices (PPI) rose at the fastest pace in three years in July. This contrasts with US consumer prices (CPI) published last Tuesday, which remained unchanged from June despite forecasts predicting an increase.

The odds of a September rate cut - previously seen as certain following softer CPI data - fell to 85% on Monday, according to the CME derivatives exchange’s FedWatch tool. This shift occurred despite US Treasury Secretary Scott Bessent urging last Wednesday that the Fed begin a cycle of cuts, suggesting a 50-basis-point reduction in September and arguing that the benchmark rate should be at least 150 basis points lower than its current level.

At the previous FOMC meeting in July, Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller – both voting members and potential successors to Powell when his term ends in May 2026 – expressed support for an interest rate cut. Since then, FOMC members have been divided on whether to begin cutting rates for the first time since December at the mid-September meeting.

Earlier this month, Trump nominated Stephen Milan, Chairman of the White House Council of Economic Advisers (CEA), to fill the vacancy left by Adriana Kugler, who resigned mid-term. If confirmed by the US Senate, Milan may participate in the September meeting.

“Gold has climbed this year as the dollar has weakened without the Fed cutting rates,” said German refining group Heraeus in its latest note.

“So, if Fed cuts weaken the dollar further, that could help lift the gold price.”

In 2025, the precious metal has surged 27.8% in US dollar terms, with increases of 18.4% and 14.1% in UK pounds and euros, respectively.

Gold priced in UK Pounds and Euros meanwhile rose 0.5% and 0.6% on Monday, reaching £2471 and €2866 per ounce.

European Commission President Ursula von der Leyen, German Chancellor Friedrich Merz, UK Prime Minister Sir Keir Starmer, French President Emmanuel Macron, Italian Premier Giorgia Meloni, Finnish President Alexander Stubb, and NATO Secretary-General Mark Rutte confirmed they would attend the Washington talks.

According to a German official, Zelenskyy is scheduled to meet privately with Trump before joining the other leaders for a working lunch followed by further discussions.

Topics expected to be discussed include security guarantees, territorial issues, sanctions, and financing for Ukraine’s armed forces, the official said.

At the Alaska summit, Trump and Putin agreed to push directly for a peace agreement without an immediate ceasefire, which Trump had previously demanded.

“President Zelenskyy of Ukraine can end the war with Russia almost immediately, if he wants to, or he can continue to fight,” Trump wrote on social media Sunday night, emphasizing that Ukraine must relinquish Russian-annexed Crimea and abandon its ambitions to join NATO - a key demand from Putin.

Steve Witkoff, the US special envoy, said on Sunday that during his meeting with Trump, Putin agreed to allow the US and its allies to provide Ukraine with a security guarantee similar to NATO’s collective defence commitment.

But US Secretary of State Marco Rubio suggested that Moscow still had to commit to the plan.

“These are decisions to be made by Ukraine and Ukraine alone,” von der Leyen said regarding territorial questions at a joint news conference with Zelenskiy in Brussels on Sunday.

“And these decisions cannot be taken without Ukraine at the table.”

Email us

Email us