Record Trading, Record New Gold and Silver Buyers

New Year sets $1 billion gold and silver record at world No.1...

GOLD and silver's dramatic start to 2026 has seen trading and investment records tumble here at BullionVault, reports Adrian Ash at the world-leading precious metals marketplace.

Launched in 2005 and now caring for a record $10.8 billion (£7.9bn, €9.1bn) of gold, silver, platinum and palladium for its users, BullionVault enables private investors to buy and sell securely stored precious metal from as little as 1 gram at a time.

Our simple, secure, low-cost precious metals service attracted a record number of new users in January, outrunning the previous monthly high by a massive 80.9%.

Gold and silver trading on BullionVault set a new record too, with $1.1 billion of physical metal changing hands last month (£854m, €983m), more than 3.5 times last year's 12-month average.

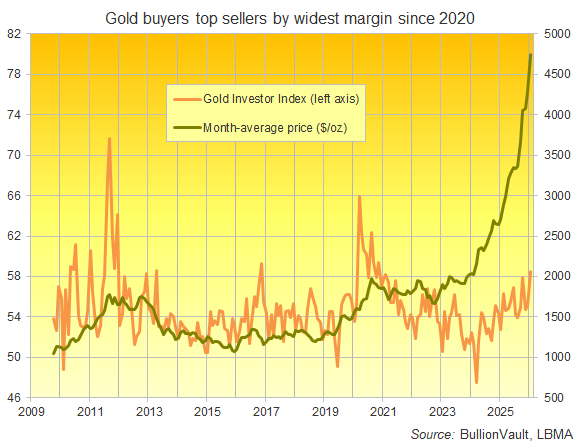

Last month's huge price moves also drew a record number of both buyers and sellers to gold and silver, with buyers outnumbering sellers by 2-to-1, the widest margin since the Covid pandemic.

Record-high prices, in short, are meeting record trading and demand in gold and silver.

New investors starting to build their holdings are, of course, smaller than the average position held by longer-term owners. But while leveraged speculators chase their tails in derivatives bets and exchange-traded contracts, that means the physical bullion market is evenly balanced overall.

With the price of gold surging by 10.6% in January to average a record $4744 per Troy ounce (+9.3% to £3506, +10.3% to €4039), the number of people choosing to sell gold on BullionVault jumped by 48.9% to a new monthly record.

But the number of buyers rose faster to a new record of its own, jumping by 57.7% with the sharpest increase since the Covid crisis went global in March 2020.

Together, that put the Gold Investor Index − a unique measure of actual buying and selling decisions in the 'safe haven' metal − higher by 3.4 points from December at 58.5, the strongest reading since the depths of the pandemic in November 2020.

Any reading above 50.0 signals that the number of buyers was greater than the number of sellers. The Gold Investor Index set an all-time peak of 71.7 in September 2011 − peak of the global financial crisis − and it fell to a series low of 47.5 in March 2024 as a rise in prices driven by central-bank buying and Chinese demand spurred profit-taking by Western private investors.

Here in February 2026, the past week's huge spike and crash in gold and silver prices now puts the hard-money metals back at were new all-time highs only a couple of weeks ago. New account openings show no sign of slowing down. The monetary and political backdrop meanwhile remains very positive for precious metals in 2026.

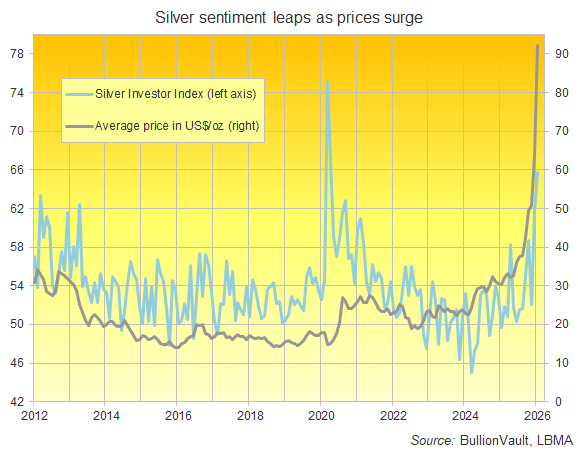

December had already drawn a record number of both buyers and sellers in silver on BullionVault.

But those figures leapt by a further 62.9% and 85.9% respectively in January as the precious metal made its steepest month-average price rise since New Year 1980, jumping by 43.2% to $92.13 per Troy ounce (+41.6% to £68.08, +42.7% to €78.41).

That saw the Silver Investor Index hit a new post-pandemic high, extending the prior month's 9.6-point leap with a rise of 4.0 points in January to 65.7, the strongest reading since April 2020.

The Silver Investor Index set a lifetime record of 75.1 in March 2020 as buyers leapt on the industrially-useful precious metal's Covid crisis price crash. Its series low came on heavy profit-taking in March 2024.

By weight last month, customers of BullionVault sold 25.8 tonnes of silver more than they bought as a group, marking the heaviest net liquidation since the record outflow of 32.2 tonnes in April 2024. This January's net selling took the total quantity of silver owned by BullionVault users 2.2% lower to 1,126.3 tonnes, the smallest since November 2020 but worth a new record of $3.7bn (£2.7bn, €3.1bn, ¥577bn).

Gold in contrast saw only a little net selling overall in January, with BullionVault users liquidating less than 32 kilograms to cut total client holdings by 0.1% to 43.5 tonnes. While that was the smallest quantity since June 2020, it was worth a new record of more than $6.9 billion (£5.0bn, €5.8bn, ¥1.0 trillion).

Finding 9-in-10 of its client base in Western Europe and North America, BullionVault last month saw an unprecedented number of private investors use its platform for the first time, with the count of new customers leaping by 122.5% compared to December's figure and beating 2025's month-average by 338.9%.

The number of new UK users beat its previous record (August 2011) by 85.3% and the Eurozone topped its prior peak (March 2020) by 31.9%. But the USA lagged its all-time peak (August 2011) by 42.4%, extending its run of relative under-performance.

Maybe US investors aren't feeling as shaken as Western Europeans? Or maybe they feel they have already missed the big moves in precious, having sat it out − relatively speaking − during the 2025 price surge?

The single largest group of gold sellers was, for the third month running, investors who had first bought the precious metal in 2025. Outnumbering every other calendar-year cohort, last year's new buyers were on average over 1/3rd more likely to sell all or part of their holdings (37.2%) than investors who had begun buying during BullionVault's first 20 years in business.

And why not?

Putting $1,000 into gold using BullionVault last year offered a new investor, on average, a net profit this January of 32.0% after all dealing and custody costs (28.6% on £1,000 or 27.1% on €1,000).

The same sum of Dollars put into silver in 2025 would, on average, have offered an investor using BullionVault a net profit of 118.7% last month (113.3% in UK Pounds, 110.9% in Euros).

The past is no guarantee of the future, of course. And the past week − like the 2013 gold crash or the 1980 and 2011 spikes-and-slumps − shows that precious metals prices can go down even faster than they went up.

But if you're researching how the precious metals market might move from here, and you want to make investing in physical bullion simple, safe and cost-effective, take a look at trading secure and insured gold or silver online or using your smartphone at BullionVault.

Email us

Email us