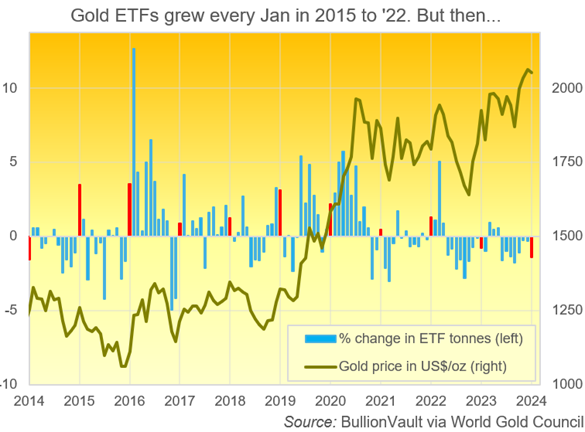

Correlation Breakdown x 3 in Gold

- gold in Jan 2024 dropped less than US$10 from end-December's record-high finish of $2062 per Troy ounce;

- gold actually rose last New Year when investment demand also shrank; and

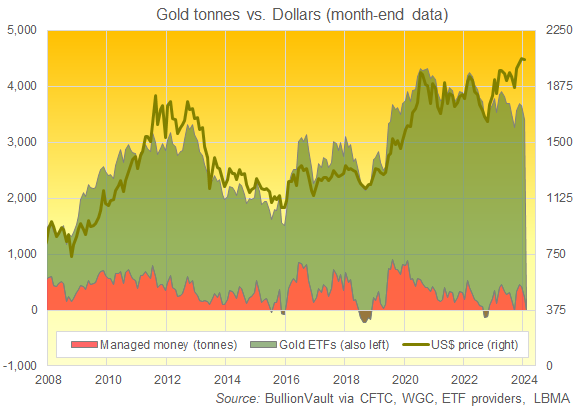

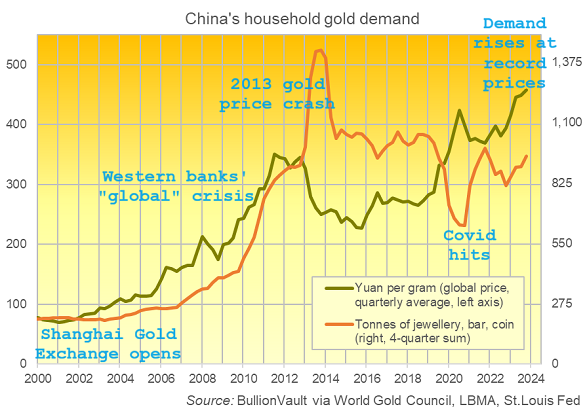

- most starkly, the broader correlation between gold's price and demand to invest has broken down anyway.

Email us

Email us