Gold Jumps, Silver Soars to $53 as US Fed Preps 'Ample' Liquidity Bond Buying

GOLD JUMPED and silver prices leapt on Wednesday, slashing the 'safe haven' precious metal's value relative to its more industrially-useful cousin to the lowest in a month as the Federal Reserve signalled it's about to re-start buying bonds to ensure "ample" liquidity while global stock markets rose ahead of US politicians voting to end the record-long shutdown of US government services.

US stock markets opened higher and European bourses hit new all-time records as gold priced in Dollars rallied from $4100 per Troy ounce to hit a new 3-week high at $4180 − a fresh record gold high only a month ago − after New York Fed chief John Williams said it will soon be time "to begin the process of gradual purchases of assets [to] maintain an ample level of reserves" to meet commercial bank demand for liquidity.

With Trump appointee (and White House economist) Stephen Miran also due to speak Wednesday, 'neutral' Fed member Raphael Bostic meantime announced that he will stand down from the Atlanta Federal Reserve at the end of his current term in February, opening another monetary policy spot to nominations from the Trump White House.

Silver had already shot higher, rising above $52 per Troy ounce − also a new all-time high when first reached this time last month − before breaking $53 to trade 9.8% above last weekend's level.

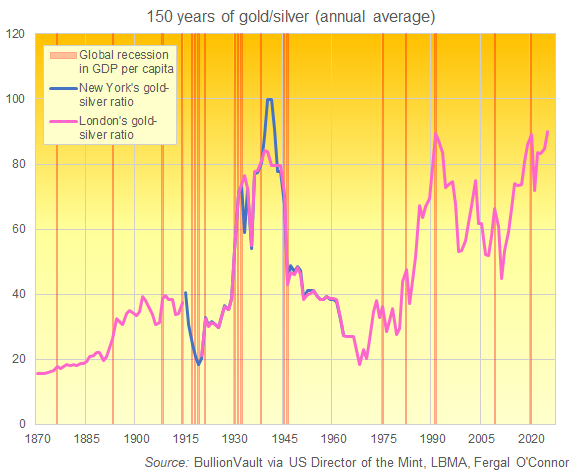

That cut the Gold/Silver Ratio − a simple measure of the two formerly monetary metals' relative prices − to its lowest in a month below 80 ounces of silver per 1 ounce of gold.

The gold-silver ratio has so far in 2025 set its highest annual level ever outside of WW2, topping the level hit during the global economic recessions of 1991 and 2020 to average more than 90.

"Silver seems to have regained its role as a bellwether or leading indicator for activity across the broader metals complex," says the latest weekly note from Japanese conglomerate Mitsubishi's precious metals team.

Like platinum, palladium and also copper, "it has been added to the US government’s Critical Minerals List, underscoring its dual character both as an industrial metal and as a speculative asset that tends to attract attention when markets look unsettled.

"Meanwhile, Chinese solar manufacturers have reported strong demand in the photovoltaic sector, although continued efforts to reduce silver through substitution will likely limit the upside.

"All of this suggests silver prices may remain volatile and subject to sharp swings. But overall, silver’s supply-demand fundamentals remain constructive, and for now, the path of least resistance still appears to be higher."

India's surging silver jewellery demand has also seen exchange-traded products record "a remarkable year so far in 2025," say specialist analysts Metals Focus, with "strong investor interest in silver...doubling India's share of global silver ETP holdings to around 8% by September.

"Multiple factors have fuelled this demand and, while the pace of inflows may moderate as recent investor enthusiasm cools down, they are expected to remain robust through the coming year."

Following last month's dramatic silver squeeze in London − heart of global bullion trading and storage − "The London silver market has found increased liquidity over the past couple of weeks," says bullion analyst Rhona O'Connell at brokerage StoneX, "as metal has been pouring in."

With data from trade body the LBMA showing a record inflow of silver to London vaults across October, that has reversed the post-April rise in New York warehouse stockpiles, spurred by ongoing fears that the Trump administration will impose US import tariffs on the precious metal − fears revived by last week's addition of silver to the "critical minerals" list.

With private-sector data yesterday reporting a drop in US employment during October, voting to re-start financing government agencies would mean "paving the way to clear a fog [of official data] that has fuelled US economic uncertainty," says Reuters.

In the month following previous US government shutdowns, both the benchmark S&P500 stock index and the price of gold "saw increases 60% of the time" since 1976, says MarketWatch analysis of Dow Jones Market Data.

"London silver still remains tight," says O'Connell at StoneX, noting that spot bullion versus the most-active US Comex futures contract still show "a backwardation, albeit a small one," pricing immediate delivery above future settlement and signalling a relative shortage of freely available metal.

With London copper prices meantime rallying 2.0% from last Wednesday's 2-week lows, New York copper futures today rose to 2-week highs near $5.14 per pound, extending their small premium to LME physical quotes.

That was still almost 15% below July's all-time high for CME copper futures above $6 per pound, hit and then lost after the Trump administration imposed and then back-tracked from heavy import tariffs on the essential base metal.

Email us

Email us