London Silver Market 'Broken' as Gold Nears $4100, US-China REE Trade Row Worsens

GOLD and SILVER PRICES hit record highs on Monday as US President Trump's peace plan ceasefire between Hamas and Israel was offset by deepening US-China trade tensions, with the dislocation between London and New York precious metals prices worsening in an "unprecedentedly" tight market now called "broken" by many analysts and traders, writes Atsuko Whitehouse at BullionVault.

On Friday, President Donald Trump threatened to impose 100% tariffs on China by 1st November, accusing Beijing of becoming "very hostile" in its decision to impose export controls on rare earth minerals needed in a host of technologies (REEs).

With Trump saying he wants " to help China, not hurt it," Beijing said the US should stop threatening it with higher tariffs and urged further negotiations to resolve outstanding trade issues.

The Trump administration is currently reviewing 'critical mineral' status for silver, which finds over half of its demand from industrial and technology uses, and which is now in its 5th year of deep supply deficits versus silver demand worldwide.

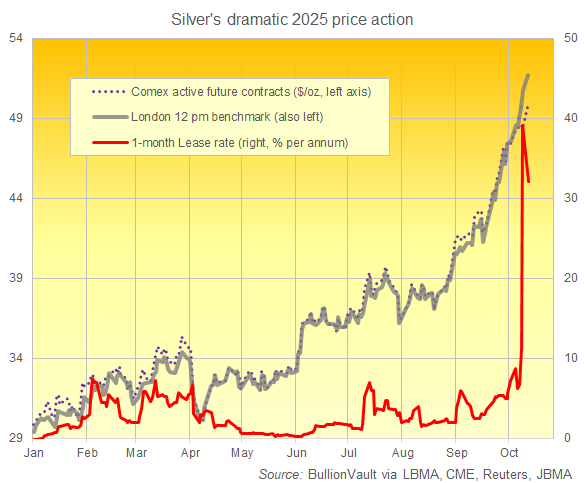

The price of silver soared again Monday, up 1.9% to a new Dollar peak of $51.71 per ounce by lunchtime in London, marking a 78.9% annual rise so far, the fastest yearly gain since 2010.

Silver futures on the CME's Comex rose 3.3% to $50.00 per ounce for December settlement, slightly trimming the record discount for New York settlement to $1.70 from $2.40 in the previous session compared to loco-London physical prices.

"A historic short squeeze in the London cash market spilled over to Comex futures in New York," says the latest note from derivatives platform Saxo Bank's Strategy Team.

Borrowing costs in London leapt last week to nearly 40% per annum on 1-month lease rates before falling to 32% today, still an unprecedented level historically, as wholesale bullion dealers reported wide spreads and delayed settlement times in major centres from London to Zurich and Singapore for gold, silver, platinum, and palladium.

"I have never seen rates like this in silver in 39 years in the market," says Bruce Ikemizu, Chief Director of the Japan Bullion Market Association (JBMA).

"The unprecedented tightness in silver and volatility in the basis/EFP is leaving the lynchpin of the OTC physical market [in London] broken," said Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp.

"There's regional shortages, there's not yet global shortages compounded by logistical issues and a lack of risk appetite," Shiels added.

"Tariff nervousness has been keeping silver in the US," said Rhona O'Connell of brokerage StoneX Group Inc., citing those concerns, along with strong Indian demand for Diwali plus soaring borrowing rates, as reasons behind the spike in the silver market.

Silver and platinum group metals remain exempt only in large wholesale bullion-bar and newly mined doré form − unlike gold, which is zero-rated for all bullion bars as well as coins, industrial powder, and leaf − under the latest US country-based tariffs.

US equity futures indicated that stocks were set to rebound on Monday after falling in the previous session. With Trump threatening a "massive increase" in duties on Chinese goods, the S&P 500 dropped 2.7% and the tech-heavy Nasdaq Composite slid 3.6%, marking their worst declines since 10th April, which followed Trump's initial "Liberation Day" tariff announcement.

"Renewed trade tension saw strong haven buying for gold and other precious metals," says Daniel Hynes, senior commodity strategist at Australasian bank ANZ.

Spot gold jumped as much as 2.9% on Monday to a new high of $4095 per ounce, recording a 56.6% year-to-date gain − the strongest annual rise outside the oil crises of the 1970s.

European stocks also rose on Monday, with the Stoxx Europe 600 index up 0.3% by Monday lunchtime.

In contrast, Asian stocks fell, with mainland China's CSI 300 index closing 0.5% lower and Hong Kong's Hang Seng index dropping 1.7%, despite Trump's more conciliatory tone toward China on trade negotiations.

Gold prices on the Shanghai Gold Exchange, meanwhile, rose 2.9% to ¥924 per gram and continued to show a historic discount to London, easing to $33 per ounce on Monday after wholesale bullion in the metal's No.1 consumer market saw the weekly average discount widen to $54 last week − the biggest since the Covid crisis in 2020.

Gold prices in major currencies also climbed to all-time highs, with the yellow metal in UK Pounds rising as much as 1.9% to £3061, while wholesale bullion in Euros gained 2.0% to €3529 per ounce.

Platinum, which finds two-thirds of its demand from industrial uses, jumped as much as 1.9% to a more than 12-year high of $1665 per ounce, extending its year-to-date rally to 82.2%.

Palladium – which finds well over four-fifths of its end-use demand from auto-catalysts used to cut carbon emissions from gasoline engines – also gained 1.0% to a two-year peak of $1469, up 61.6% so far this year.

Meantime in the Middle East, all 20 remaining Israeli hostages held in Gaza have been released and returned to Israel under the US-brokered ceasefire, which also includes the repatriation of 28 deceased hostages' bodies plus the release of over 1,900 Palestinians from Israeli detention.

Email us

Email us