Record Gold Tops $3600 as Dollar Falls, Trump Confirms 'No Tariffs'

GOLD PRICES broke through $3600 per ounce on Monday, the 31st daily high of 2025, as the US Dollar weakened to a 6-week low, writes Atsuko Whitehouse at BullionVault.

Spot gold jumped as much as 0.8% to $3621, heading for a second consecutive session record at London's afternoon benchmarking auction, following news of the weakest US job growth – outside of the 2020–2021 Covid shock – in 14 years last Friday.

The odds of "three rate cuts" by the end of 2025 rose to over 74% on Monday, up from 40% a week ago after the soft non-farm payrolls data, according to the CME derivatives exchange's FedWatch tool.

The Dollar Index – a measure of the US currency's value versus its major peers – today edged lower to its weakest since 25th July, as markets weighed rising expectations of Federal Reserve rate cuts amid concerns about the Trump administration's interference with the Fed's independence, and the resulting fears of widening fiscal deficits.

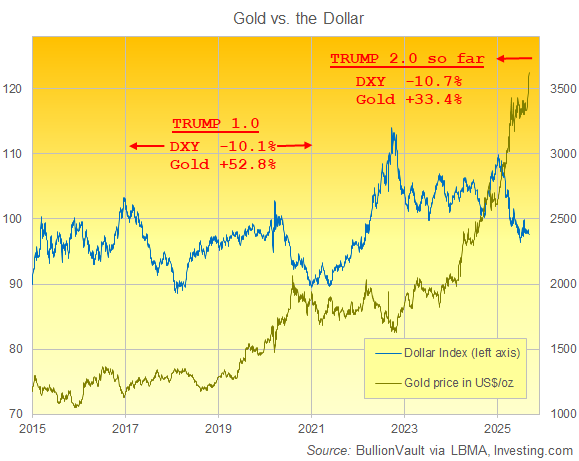

Since Donald Trump returned to the White House on 20 January, the US Dollar has weakened 10.7% on its DXY index, while gold has risen 33.4%.

"It is the weakening of the Dollar," answered Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp, when asked by Japanese financial newspaper The Nikkei why gold is rising.

"The Dollar is losing favour amid factors such as US tariff policies.

"With fiscal discipline easing globally, including in the US, and money supply reaching record highs, the value of tangible assets like gold and other precious metals is rising relatively.

"Silver and platinum, which are undervalued compared to gold, have the potential for even greater increases."

Prices for silver – which finds nearly 60% of its annual demand from industrial uses – rose as much as 1.5% on Monday to $41.34 per ounce, matching the 14-year high reached last week.

The grey metal has risen 35.6% since Trump returned to office in January.

Platinum, which draws two-thirds of its demand from industrial uses led by auto-catalysts, also rose 1.5% to $1407 per ounce. The white metal has surged 48.6% since Donald Trump began his second term in the White House less than eight months ago.

The US President on Friday signed an Executive Order to overturn this summer's shock ruling from the US Customs and Border Protection (CBP) and make all gold bullion bars, as well as coins plus industrial powder and leaf, zero rated for his new country-based tariffs.

Silver and platinum group metals, however, remain exempted only in large wholesale bullion-bar and newly-mined dore form.

The US Geological Survey (USGS) meanwhile proposed adding silver to its list of critical minerals on 26th August. Platinum has already been classified as a critical mineral by the USGS since 2022.

"With silver being recently added to the US government's critical minerals list, which is currently subject to a section 232 investigation, the US market's concern is that the metal might be subject to tariffs," said analyst Bernard Dahdah at French investment bank and London bullion market-member Natixis.

Trump already said on 11th August in a social media post that imports of gold will not face US tariffs, after a CBP ruling pushed gold futures to a then all-time high of $3514.

That federal ruling also made the New York gold premium – the difference between physical bullion quotes in London and the most-active US Comex futures contract – surge to more than $100, causing chaos and confusion in global bullion markets.

The People's Bank of China meantime announced a 2-tonne increase in its gold reserves for August on Sunday.

It was the tenth consecutive monthly addition according to State Administration of Foreign Exchange (SAFE) data, bringing its gold reserves to 2,302 tonnes, the sixth largest official central bank gold reserve in the world.

Gold prices on the Shanghai Gold Exchange today rose 0.9% to ¥819 per gram – still ¥11 below the all-time high on 22nd April.

That meant Shanghai gold continued to show a discount to London, widening to $21 per ounce today after wholesale bullion in the metal's No.1 consumer market turned to a discount of $13 last week, indicating weaker demand.

Gold priced in UK Pounds and Euros meantime rose 1.0% to fresh highs at £2681 and €3090 per ounce.

"I expect the price of gold to keep rising, driven by expectations that some foreign demand will continue to shift from US Treasuries to gold, as foreign investors lose confidence in the US," says a US economist to the Financial Times, adding that he also expected the value of the Dollar to keep declining.

Email us

Email us