Gold Slips But $5000 Forecast If Bonds Sink on Trump's Fed Independence Attack

GOLD and SILVER PRICES fell from yesterday's fresh record and 14-year highs on Thursday as weaker US economic data saw the stock market rise while traders bet that the Federal Reserve is near-certain to cut overnight interest rates amid President Trump's "attack" on the central bank's independence.

Plunging $60 per ounce overnight from Wednesday's new all-time peak of $3578 per Troy ounce, the price of gold then rallied back to $3546 as July's US trade deficit in goods blew past forecasts at $103 billion and data for last week's new jobless benefit claims reached the highest since June.

Platinum erased all of this week's prior 5.1% jump to $1441, but silver set its highest London midday auction price since September 2011 close to $41 per Troy ounce before slipping 50 cents.

The S&P500 stock index rose 0.3% to its highest since last Thursday's record close, while longer-term interest rates edged back down to 4.20% per annum on Washington's benchmark 10-year Treasury bond.

The Justice Department meantime, now led by Trump appointee Pam Bondi, has opened a criminal investigation into US central bank policymaker Lisa Cook, the Wall Street Journal reports, after allegations that the Federal Reserve governor made fraudulent home-loan applications saw President Trump fire Cook from the Fed last month − a move she is challenging in court, with Trump demanding that the appointed judge recuse herself.

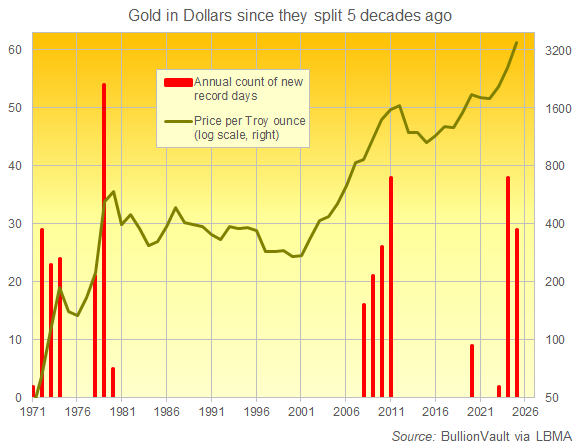

With gold already making 29 new daily highs in 2025, "A scenario where Fed independence is damaged," say analysts at US financial giant Goldman Sachs, "would likely lead to higher inflation, lower stock and long-dated bond prices, and an erosion of the dollar's reserve-currency status.

"In contrast, gold is a store of value that doesn't rely on institutional trust."

"The most important job of the central bank is to prevent Depressions and hyperinflations," said Trump's latest nominee to the Fed (and current economic advisor to the White House) Stephen Miran to the Senate Banking Committee yesterday.

"Independence of monetary policy is a critical element for its success."

But "right now," says Massachusetts' Democrat Senator Elizabeth Warren, "the banking committee should be investigating the President's direct attacks on Fed independence, not pretending that it's business as usual.

"This isn't a theoretical argument here. Countries where authoritarians take control of the central bank suffer from higher inflation."

Trump seizing control of Fed policy "would be a very serious danger for the US economy and the global economy," said Eurozone central bank chief Christine Lagarde in response to a journalist's question on Monday.

"This is a very serious situation, I am very concerned," agreed UK central bank chief Andrew Bailey on Wednesday, warning Parliament that the loss of Fed independence would be a "very dangerous road to go down."

Highlighting the upside risk to gold prices from Trump's attack on the Fed, "We estimate that if 1% of the privately owned US Treasury [bond] market were to flow into gold," says Goldman Sachs' analysis, "the gold price would rise to nearly $5000 an ounce, assuming everything else constant.

"As a result, gold remains our highest-conviction long recommendation in the commodities space."

"I'm not going to explain our sources and methods, where we get tips from, who are whistleblowers," says Bill Pulte, source of the Cook allegations, appointed by Trump as director of the Federal Housing Finance Agency, and a repeated critic of the Fed for failing to cut interest rates as the President has demanded.

"It would be reckless for me to do that," Pulte told CNBC's Squawk Box show in an ill-tempered exchange today.

Over at the DoJ, "Bondi has presided over the most convulsive transition of power since [disgraced President Richard Nixon's scandal over] Watergate, aggressively reversing policies, investigating Trump's foes and firing staff," according to a new profile in the Democrat-leaning New Yorker magazine.

Email us

Email us