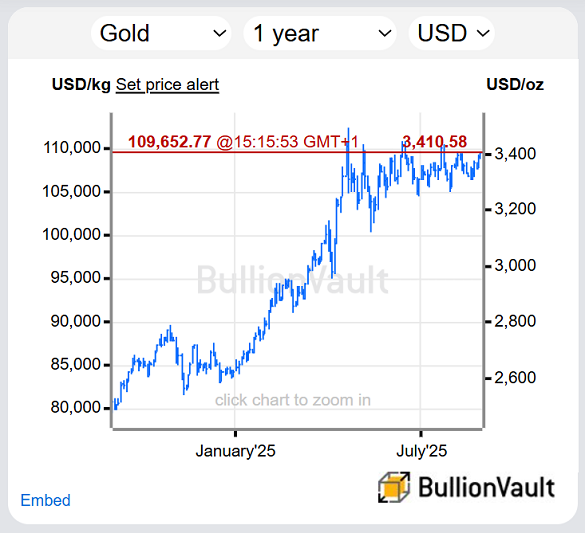

Gold $3400 'Goes Nowhere' in Summer 2025, Fed Independence Fight 'Now Key'

GOLD BULLION hit 5-week highs above $3400 per Troy ounce on Thursday, trading at the higher end of summer 2025's price range as the Dollar fell after Federal Reserve governor Lisa Cook sued Donald Trump to block the President's move to fire her from the US central bank.

"President Trump's unprecedented and illegal attempt to remove Governor Cook from her position [is] unlawful and void," says Fed Governor Cook's attorney, celebrity Washington lawyer Abbe Lowell.

With Trump repeatedly attacked Fed chair Jerome Powell for not cutting Dollar interest rates, "The Fed independence point is now really key [to] whether we have already seen the highs at that brief touch [in May] of $3500 gold," says Marcus Garvey, head of commodities strategy at Australian financial services group Macquarie.

"You've had a number of bullish developments for gold over the past 3 months, and yet it's remained rangebound.

"That indicates the rally being a little bit long in the tooth."

Touching $3410 per ounce as US trading began Thursday, gold bullion in London has now traded in a $200 range above $3250 since the start of June.

Silver meantime rose back above $39 per Troy ounce, some 50 cents below late-July's 14-year high against the US Dollar.

US government borrowing costs eased in the bond market, with 10-year Treasury yields slipping below 4.25% for the first time in a fortnight.

US equities opened flat from last night's new record high on the S&P500 stock index, while AI chip giant Nvidia (Nasdaq: NVDA) fell 1.9% despite reporting record earnings and forecasting "breakneck AI spending" by corporations worldwide.

"In terms of investor behaviour, gold's bull market looks far from its peak," says Chris Mahoney, investment manager, gold and silver at UK fund managers Jupiter.

"Indeed, far from there being any signs of mania, there is a distinct lack of participation from individual investors or institutional investors" other than central banks choosing to buy bullion.

Giant gold-backed ETF trust fund the SPDR product (NYSEArca: GLD) yesterday expanded by 0.6% to its largest size in over a week.

But open interest in US derivatives exchange the CME's Comex gold futures and options contracts shrank again, heading for its lowest level in almost 18 months.

Gold priced in the Euro today rose towards the highest in 3 weeks above €2920, while the price of gold in Pounds Sterling hit £2525.

As with the US Dollar and Euro price of gold, that was also a new all-time high when first hit amid April's Trump tariffs turmoil.

US economic growth for April-to-June was today revised higher to 3.3% annualized by the Bureau of Economic Analysis, while inflation on the core PCE measure − the Fed's preferred gauge − was confirmed at 2.5%.

With Monday's Labor Day holiday set to mark the end of the US summer vacation period, tomorrow will bring core PCE data for July.

Email us

Email us