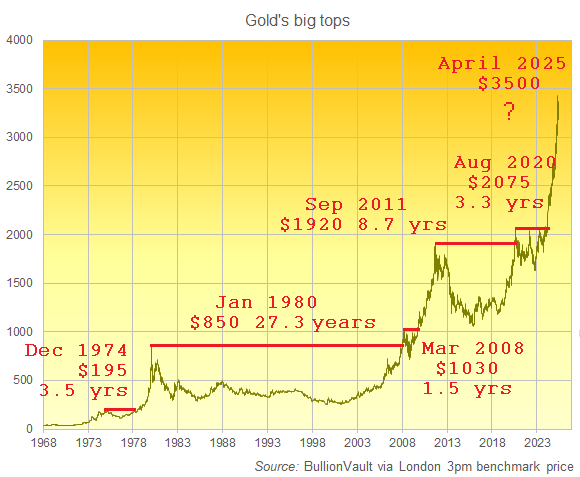

Gold All Over, Finished, Kaput After $3500 Big Top

- After December 1974's spot-market peak near $200 per ounce, gold dropped 4.1% on its monthly average price in January '75;

- January 1980's near-three-decade peak of $850 was followed by a month-average drop of 1.5% in the February;

- Gold's $1000 top of March 2008 saw the price drop 6.1% on April's month-average;

- September 2011's spot-market high of $1920 was followed by gold trading 6.0% lower across the October; and

- August 2020's peak at $2075 was followed by gold losing 2.4% on its month-average basis that September.

Email us

Email us