Gold Hits New $3500 Record Thanks to Silver, Debt, Inflation, the Fed, or Trump

The GOLD PRICE broke a new spot-market high above $3500 per Troy ounce on Tuesday, setting fresh records at London bullion's benchmarking auctions as Western stock markets dropped with the price of long-term Western government debt, driving borrowing costs higher.

With the Dollar price topping April's brief print of $3500 gold, the Japanese Yen and UK Pound price of bullion also set fresh record highs at ¥16,693 per gram and £2613 per ounce respectively.

But the Euro and Chinese Yuan price of gold both held beneath their spring highs, while the MSCI World Index of rich-economy stock markets fell 1.5% from last Thursday's new all-time record.

"If you were a Martian and you came to Earth today and you saw what's been happening to precious metals and what's happening to the long end of the bond curve, it's really telling you there are concerns," says Ella Hoxha, head of fixed income at $100bn UK asset managers Newton.

"I think we are at...an important macro cross-juncture. It's difficult to exactly time [but you can] see the writing on the wall [about] the right tail on inflation risk."

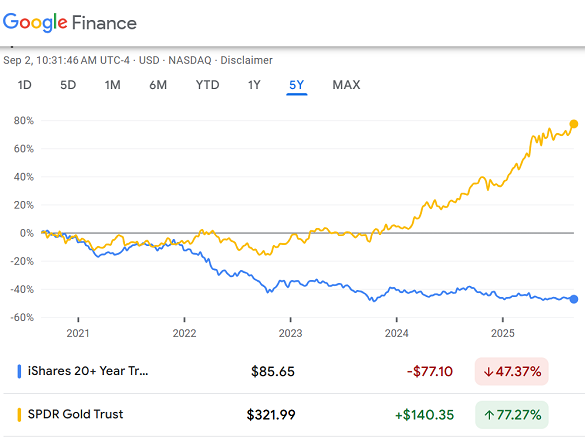

But the split between government debt and gold prices has been long underway, with the Dollar price of gold now rising 75% from 5 years ago while the value of longer-term US Treasury bonds has halved.

"We are also yet to see signs of rising inflation signals from the bond market," says Bitcoin and gold fund manager Charlie Morris in his Multi-Asset Investor newsletter, "as inflation-linked bonds are yet to show signs of resilience.

"They should outperform if inflation is coming, and they are not. That means this is a fiscal crisis, rather than an economic crisis [because] government spending remains in deficit in most major countries [and] there is falling confidence given that this can’t continue indefinitely."

"Gold surges after Trump's Fed pressure," says the Financial Times meantime, after the US President demanded that the judge appointed in US central-bank policymaker Lisa Cook's legal attempt to overturn Trump 'firing her' should stand down over personal links to the Federal Reserve governor.

"Gold hits record high above $3500 as rate-cut bets fuel demand," adds Bloomberg, even though betting in the futures market today put the same odds on Fed rate cuts − both for this month and by the end of the year − as it did a week ago at gold prices more than $100 lower.

The gold move has "no discernible trigger apart from piggybacking on silver," says analyst Rhona O'Connell at brokerage StoneX, pointing to last week's proposal from the US Department of the Interior to add the industrially-useful precious metal to the list of 'critical minerals' needing trade tariffs and government grants to boost domestic supplies.

That news "helped to fuel the surge through $40" in silver, O'Connell says, and "Momentum traders obviously also became involved."

Email us

Email us