Gold Tops Record as Fed Rate Forecasts Sink on Jobs Slump

The GOLD PRICE leapt to a fresh Dollar high on Friday, topping Wednesday's peak by $18 per ounce as the US currency sank with Fed interest rate forecasts after the world's largest economy reported the weakest jobs growth, outside of the 2020-2021 Covid shock, in 14 years.

Ahead of the BLS release, betting on the Federal Reserve's policy decision in 12 days' time put the odds of a quarter-point interest-rate cut at 99%.

That fell to 88% after the jobs data, with 12% suddenly backing a half-point cut at the Fed's September meeting according to data from the CME derivatives exchange.

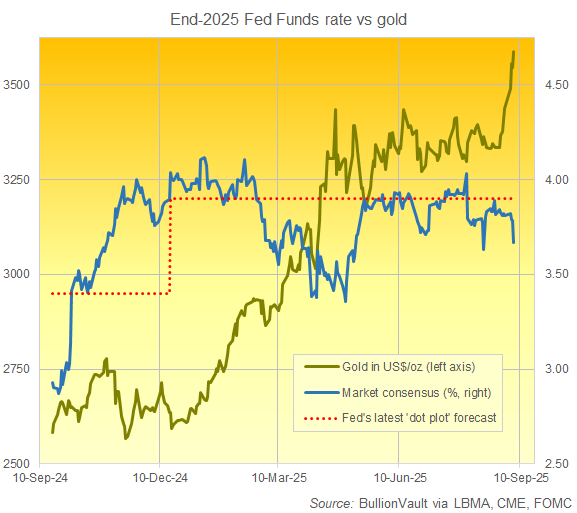

The CME's FedWatch tool also showed a marked shift lower in traders' year-end Fed Funds rate expectations following the weak NFP report, falling from 3.78% to 3.75% − the lowest level since mid-August's release of softer-than-expected US CPI inflation figures.

The Fed itself − repeatedly under 'attack' by the Trump administration for not yet restarting its rate-cutting cycle − is due to update its own year-end 'dot plot' interest rate outlook at this month's meeting having repeated its forecast of 3.90%, around half-a-point lower from the current level.

After Thursday brought a raft of weaker US economic data, the Bureau of Labor Statistics today reported net hiring of just 22,000 by US employers in August, less than 1/3rd the consensus forecast.

June's figure was also revised sharply lower and July's a little higher. Altogether, that took August's year-on-year growth in total non-farms payrolls below 1.5 million, the weakest expansion outside the 2020-2021 Covid pandemic since June 2011.

Silver leapt alongside the gold price, rebounding by 60 cents within 9 minutes of the BLS releasing its first NFP estimate for last month, peaking 20 cents below Wednesday's 14-year high of $41.46 per Troy ounce.

The Dollar meantime erased this week's previous rally against the Euro and Japanese Yen, while Treasury bonds jumped in price, driving the yield offered by 10-year debt down 8 basis points to 4.08% per annum − the steepest 1-day drop in longer-term interest rates since last month's release of July's weak data.

"Our Economy is booming, and E.J. will ensure that the Numbers released are HONEST and ACCURATE," said President Trump after firing Bureau of Labor Statistics chief Erika McEntarfer that day and then nominating long-time BLS critic and conservative think-tank economist E.J.Antoni to replace her.

Having peaked at $3578 gold on Wednesday, the Dollar price of bullion today peaked at $3595 per Troy ounce, setting its 30th new record London benchmark price of 2025 so far and rising 4.8% from last Friday's 3pm Fix with its steepest weekly gain since mid-May.

While the Euro price of gold didn't quite reach Wednesday's new spot-market peak, it leapt to €3060 per Troy ounce, adding 4.4% for the week.

The UK gold price in Pounds per ounce meantime rose to £2653, some £15 beneath Wednesday's top, with a weekly rise of 4.2%.

US stocks meantime joined global equities in rising once more after the jobs data, taking the S&P500 index up to its 22nd new daily high of the year so far.

Email us

Email us