Gold Hits Fresh Records Amid ETF and Speculative Comex Trading

GOLD PRICES surged to fresh record highs in all currencies except the Chinese Yuan in Asia's trading on Wednesday, going on to fix above $3500 per Troy ounce for the first time ever at London's daily benchmarking auctions as gold ETFs swelled fast and speculative trading leapt in New York Comex futures and options.

Western financial assets rallied after 4 days of losses in stocks and bonds.

China made a dramatic show of strength at a military parade to mark 80 years since the defeat of Japan in WW2.

"Strong additions to gold and silver ETFs," notes analyst Rhona O'Connell at brokerage StoneX, also pointing to how, in recent days, the price of gold has shown a positive correlation with the so-called 'fear gauge' of the VIX volatility index of US equity prices.

Another surge of money into the giant GLD gold ETF yesterday took its number of shares in issue to the most in 3 years, up 3.2% in just 1 week.

For New York's main Comex gold futures contract, "the anticipation for the next CFTC print [of trader positioning], due Friday, is building fast," says a note from London bullion bank ICBC Standard.

"There is no doubt...we will see a large jump in non-commercial [ie, speculative] longs judging from the large spike in open interest week on week."

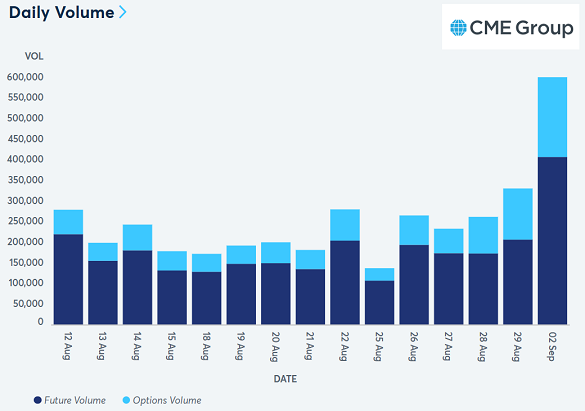

With open interest in Comex gold derivatives jumping 11.4% in futures contracts and 14.0% in options over the past week, trading volumes in both products leapt yesterday to the highest since gold's previous attempt to breach $3500 per ounce back on 22 April, amid the stock-market rout following President Trump's 'Liberation Day' trade tariffs shock.

Gold priced in the US Dollar today jumped as high as $3560 per Troy ounce in London spot market trade, rising 3.8% for the week so far.

Gold also set a second day of new all-time highs at €3057 for German, French and other Eurozone investors, and a 4th new daily high in Japanese Yen at ¥17,000 per gram, plus a new peak for the UK gold price in Pounds per ounce at £2651.

But gold in Shanghai had fixed overnight 2.4% below late-April's all-time Chinese Yuan peak, rising to ¥810 per gram to show a very muted premium above London quotes equal to less than $4 per ounce.

That gap typically offers an incentive for new bullion imports − out of the bullion market's No.1 trading and storage hub, into its No.1 gold consumer nation − above $7 per ounce.

"Liquidity in [US-settled] Comex gold futures during Asian hours has surged with gold prices," says Cameron Liao, director international research and product development at derivatives exchange group the CME.

"Historically, Asian hours volume (defined as 6 am to 6 pm Singapore time) accounted for approximately 25% of total trading volume; this share grew to over one-third in the second quarter of 2025."

Last month saw total volumes in the Comex's retail-trader targeting Micro Gold futures rise 54% from July, the CME said Wednesday.

"Today, humanity is again faced with the choice of peace or war, dialogue or confrontation, win-win or zero-sum," said China's President Xi at today's V-day parade in Tianamen Square, featuring troops, tanks, fighter jets and intercontinental missiles plus "AI-powered" drones and robot "wolves".

"China is never intimidated by any bullies."

"Many Americans died in China's quest for Victory and Glory," Trump responded on his Truth Social platform. "I hope that they are rightfully Honored and Remembered...

"Please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America."

US, Eurozone and UK government bond prices rallied meantime Wednesday, easing longer-term borrowing costs back from multi-month, multi-year and multi-decade highs respectively on 30-year debt.

Rich-world stock markets meantime rose for the first time since Thursday's all-time record high on the MSCI World Index.

Silver bullion prices meantime rose again alongside gold, hitting new 14-year highs in US Dollars above $41 and setting yet another all-time record in both Japanese Yen and UK Pounds.

Email us

Email us