Platinum, Gold and Silver Leap Again on 'Dollar Debasement' Trade

PRECIOUS METALS prices leapt again Tuesday, taking gold and silver to fresh records in all currencies as platinum hit new all-time highs in everything except the now fast-weakening US Dollar.

"Gold remains underpinned by geopolitical tensions in late 2025," says analyst Rhona O'Connell at brokerage StoneX.

"The reality is we still have an over-valued US Dollar from a fundamental standpoint," Reuters quotes Karl Schamotta, market strategist at global payments provider Corpay.

With traders in US Fed futures now betting on an end-2026 interest rate of barely 3.00%, nearly 0.4 points below the US central bank's latest projection, the Dollar fell to its lowest since early October on its DXY index against the rest of the Western world's major currencies.

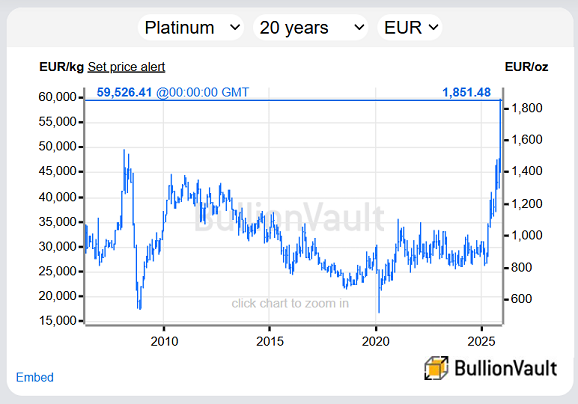

Gold peaked within $3 of $4500, while silver hit $70 − also 2.8% higher for Christmas Week so far − while platinum prices topped $2180 per Troy ounce, its highest since the all-time highs of 2008.

That put the industrially-useful precious metal at yet more record prices in terms of the Euro, Yuan, Japanese Yen, British Pounds and almost all other world currencies.

"Middle East issues are not looking any closer to resolution and the protracted negotiations over Ukraine continue to flounder," says O'Connell at StoneX, "while the tension between the US and Venezuela is adding further fuel to the fire.

"Meanwhile the 'debasement' trade continues to grip the markets and plenty of investors want to ditch the Dollar.

"This is where gold becomes pivotal."

Analysis from China's STCN said in November that Chinese commercial banks now hold some 12,000 tonnes of gold in total, more than 5 times the central bank's official gold reserves.

The Beijing authorities' attempt to limit speculation and exclude retail investors from trading on the wholesale Shanghai Gold Exchange − including new gold taxation rules − is now seeing major banks led by ICBC continue to shut margin accounts.

With gold jewellery prices in the No.1 consumer nation now topping 14,000 Yuan per gram, Chinese households have in 2025 shifted from buying adornment items to choosing gold coins, small bars, bullion-backed ETFs and digital gold investing accounts instead.

"When the rest of the world is starting to look better in terms of growth, that's favorable for the Dollar to continue to weaken," says Paresh Upadhyaya, head of fixed income and currency strategy at Europe's largest asset managers Amundi.

Email us

Email us