Gold and Silver Rebound from China's Sudden Tax and Export Rule Changes

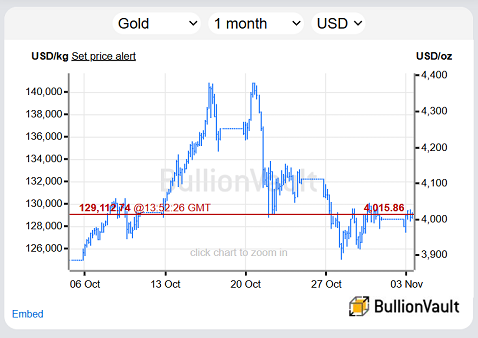

The PRICE of GOLD dropped but then recovered to keep trading above $4000 per ounce in London on Monday, holding a $1400 gain for 2025 to date despite a sudden tax change in China spurring confusion among investors and traders, plus a slump in the share price of jewelry manufacturers, in the precious metal's No.1 consumer nation.

Silver prices also fell and rebounded, holding unchanged by lunchtime in Europe around $48.75 per Troy ounce, as a separate rule change in China added the industrially-useful precious metal to a list of tightly-controlled exports including so-called rare earth minerals.

For gold bullion and jewelry, the Ministry of Finance on Saturday ended a 2-decade tax break allowing retailers to offset the full 13% cost of VAT sales tax when they re-sell physical gold outside of officially-recognized vaults, cutting the offset to 6%.

"The change raises the cost of selling or taking delivery of physical gold, particularly for traders, manufacturers, and jewellers," says the trading desk at Chinese-owned London bullion bank ICBC Standard.

For end-consumers, that means that "the addition of VAT dilutes the gold content versus the price paid," says analyst Rhona O'Connell at brokerage StoneX, "[and] therefore erodes the concept of high purity jewellery as an investment.

"Anyone wanting to sell a jewellery piece in future will automatically be 6.5% worse off on the basis of a flat gold price."

Global gold prices initially sank as this week's trading began in Asia, with London bullion down 1.0% to $3963 per Troy ounce as the Shanghai Gold Exchange's main contract lost 1.6% to re-test Friday's low of ¥906 per gram.

But both gold markets then rallied hard, with the SGE's Au(T+D) contract closing Monday just 0.3% lighter at ¥918 per gram while London bullion touched $4027 per ounce.

Down 8.0% from mid-October's 'double top' at $4381, that was a new all-time high less than 4 weeks ago.

Shares in China's giant jewelry retail companies meantime sank as trading opened this morning, with Chow Tai Fook (HKG: 1929) plunging as much as 11.4% while No.2 retailer Lao Feng Xiang (SHA: 600612) dropped towards a 3-year low on the Shanghai stock market and Luk Fook Holdings (HKG: 0590) also lost 6.9% in Hong Kong.

But overall, and despite survey data putting China's manufacturing sector close to no growth in October, the Hang Seng index in Hong Kong rose 1.0% while the CSI300 of mainland Chinese shares added 0.3% for the day, also edging back towards last month's 4-year highs.

"Just like the recent scrappage of tax break for platinum," says strategist Nicky Shiels at Swiss bullion refining and finance group MKS Pamp − pointing to Saturday's pre-announced loss of state-owned China Platinum Company's unique 15% VAT exemption − "this is a 'cleanup' rather than a 'setback' in the longer term.

"Ultimately it's bullish but the market won't see it that way initially."

"Although it may initially dampen retail and investor demand," agrees ICBC's note, "one can argue the move supports Beijing’s broader aim of strengthening Yuan-based gold trading through closer integration between Shanghai and Hong Kong" as on-exchange deals for vaulted metal retains the full offset of tax.

For retail consumers, online stores such as JD.com initially hiked their small gold-bar sale prices over the weekend, but they then pulled all such offers entirely in what appears to have been confusion and uncertainty over how the new rules will work, and at what cost.

"Merchants in the Shuibei Gold and Jewelry Market in Shenzhen stated that the policy currently has no impact on individual consumers' purchases of gold jewelry," reports China's Securities Times.

"But they also hoped for more specific and operational implementation guidelines."

In contrast to gold, silver trading on the SGE sank Monday, with the volume of metal changing hands through the Ag(T+D) contract more than halving from Friday's level to hit a 5-week low,

Shanghai silver prices still edged higher for day, cutting the drop from mid-October's new all-time high to 6.4% at ¥11,433 per kilo.

Silver bullion exports from China last year matched more than 13% of global net demand for the precious metal according to data compiled by Metals Focus for the Washington-based Silver Institute.

Now, and with US President Trump awaiting a so-called 'Section 232' decision on whether to classify silver as a "critical mineral", Chinese silver exporters will need to arrange a special license "in order to protect resources and the environment and strengthen the management of rare metal exports," according to the Ministry of Finance's weekend directive.

Trump yesterday declared that China and other foreign countries will not receive any exports of AI microchips made by Nvidia (Nasdaq: NVDA), the world's largest company with a market cap near $5 trillion.

His statement came even as the White House released details of last week's trade deal between Trump and Chinese leader Xi Jinping, including a pause on China's rare earths export block and a pause in 'reciprocal' tariffs aimed at reducing the United States' huge trade deficit in goods with the world's second largest economy.

Email us

Email us