Gold, Silver Rally as 'No Cuts' Fed Sees Jobless Rate Hit 4-Year High

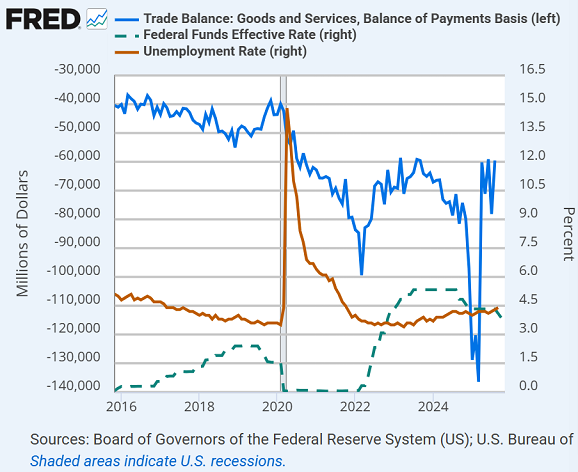

GOLD and SILVER rallied again Thursday, reversing the drop made yesterday on better-than-expected US trade data plus news that the Federal Reserve is unlikely to cut interest rates in December, as delayed jobs data for September put US unemployment at a 4-year high.

After cutting US interest rates in October, "Many participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for the rest of the year," said minutes of that Fed meeting released Wednesday, confirming 'hawkish' Fed comments made since.

August's US imports of goods and services were $59.6 billion greater than its exports, the Bureau of Economic Analysis said yesterday, close to the smallest monthly trade deficit since the fall of 2020, thanks to a sudden stop in gold bullion imports.

"Total nonfarm payroll employment has shown little change since April," said the Bureau of Labor Statistics today, reporting net jobs growth of 119,000 for September − news also delayed by the US government shutdown − and putting the unemployment rate 1 tick higher than August at 4.4%, the highest since October 2021.

Betting in the futures market today put 44% odds on a December rate cut from the Fed, up from yesterday's plunge to 30% but still contrasting with traders' near-unanimous 'dead-cert' view of a month ago.

Gold topped $4100 per Troy ounce on Thursday for the 4th time this week, trading exactly where prices stood at this point in October.

Silver meantime dropped over $2 per ounce from Wednesday's peak above $52 but then rallied to $51.25, trading 6.8% higher from one month ago.

Global stock markets rose for a 2nd session after the plunge in AI hyperscalers and crypto tokens saw the MSCI World Index record its longest stretch of losses since spring 2024, while industrial commodities such as crude oil and copper traded little changed, as did longer-term borrowing costs in the bond market.

With Western financial news focused on Beijing's "true" gold reserves while analysts point to China's larger-than-reported US Dollar reserves as well, sanctioned neighbor Russia − now discussing a 28-point peace plan proposed by the Trump White House but as yet rejected by Ukraine − says its central bank is growing gold-trading activity for Moscow's National Wealth Fund.

In contrast to today's BLS figures, US payrolls fell by 32,000 in September according to the private-sector ADP estimate, followed by growth of 42,000 in October.

August's sharp drop in US gold bullion imports came amid confusion over the White House's tariffs policy for bullion bars − confusion which wasn't dispelled until President Trump declared that "Gold will not be tariffed!" the following month.

Email us

Email us