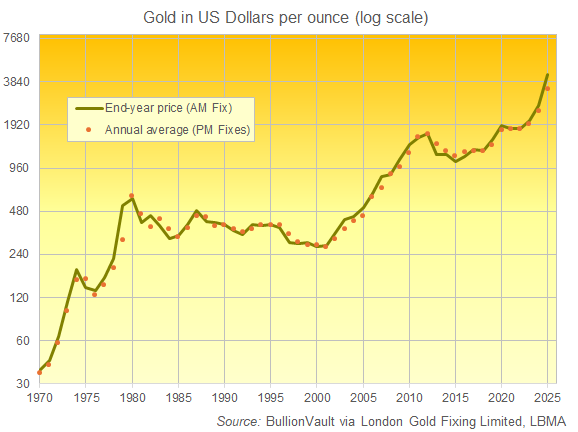

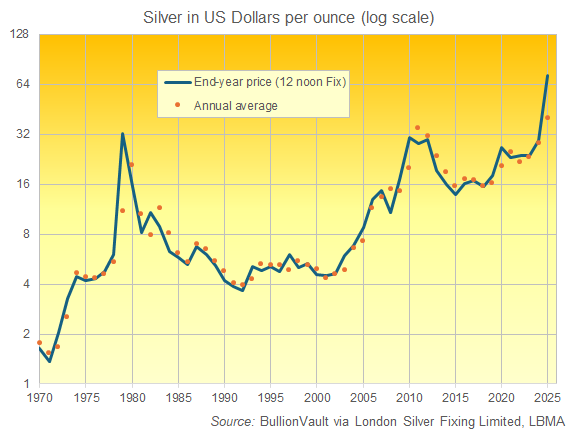

Record Gold Price Ends 2025 Up 65%, Silver Jumps 144%

GOLD and SILVER PRICES steadied from this festive season's sharp volatility as London trading ended for 2025 on Wednesday, with the two 'hard money' metals ending this year's surge of new record highs with the sharpest annual gains in more than 4.5 decades.

Following last week's Chinese Christmas chaos in precious metals trading and prices, London gold bullion fixed just beneath $4310 per Troy ounce at the City's 10:30am auction today, recording a total gain of 65.0% across 2025.

That marks gold's sharpest price rise since the record jump of 133.4% in 1979, a surge which led to January 1980's big top in gold at $850, a level it took almost 3 decades to top.

Silver bullion in London meantime fixed just below $72 per ounce at midday today, rising 144.4% from last New Year's Eve.

That marks silver's sharpest jump since 1979, when it leapt by 434.8% in US Dollar terms.

2025's silver price average topped $40 per Troy ounce, rising 41.4% from last year with its sharpest annual average increase since 2011.

Gold's annual average price came in at $3435 per Troy ounce, higher by 44.0% from 2024 for the strongest rise since gold's annual average price doubled in 1980.

Compared to analysts' gold price forecasts at the start of the year, gold's 2025 average beat consensus by 25.6%, the sharpest outperformance in the 2-decade history of trade association the LBMA polling professional traders analysts each January.

Silver's annual average of almost exactly $40 per ounce beat analyst consensus by 21.8%.

Email us

Email us