Gold Price Flatlines as Data Fog Clears for 'Hawkish' Fed

GOLD PRICES steadied Monday to trade inside a tight range in London after the 'safe haven' precious metal made its biggest daily fall in 3 weeks as financial markets put the odds of a December rate cut by US central bank the Federal Reserve at less than 50%, writes Atsuko Whitehouse at BullionVault.

With delayed US data now due for release this week after the US government shutdown ended − including the latest jobs and inflation estimates − London gold bullion traded in a narrow range of just over $50 per Troy ounce above $4050.

That came after gold prices on Friday recorded their biggest daily decline since late-October, with a near-$200 plunge cutting last week's gold gains from over 6.3% to just 2.2% in US Dollar terms.

"The shutdown is over, but the data fog it created is still clouding," says one strategist to Bloomberg, adding that "the Fed's rate-cut path is far from clear."

Betting on the odds of 'no change' at December's Fed meeting – seen as a 0% chance one month ago – rose to 55.4% on Monday, according to the CME derivatives exchange's FedWatch tool, the highest level since the last Federal Open Market Committee meeting at the end of October.

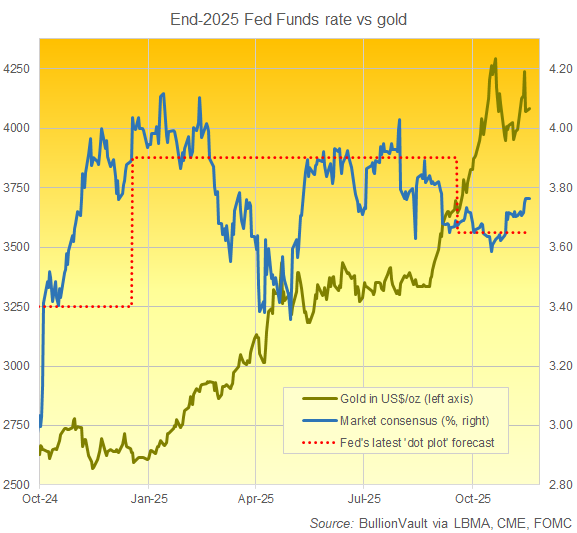

Market consensus now says Fed rates will finish 2025 at 3.76%, more than 15 basis points higher than the level forecast by the US central bank in its own 'dot plot' projections 2 months ago.

Today's market consensus marks the highest such market-implied year-end rate since early September, back before Fed policy makers cut their end-2025 prediction to 3.6% from June's forecast of 3.9%.

"I don't think further rate cuts will have much effect in patching up cracks in the labor market," said Kansas City Fed President Jeffrey Schmid – a voting member of the US central bank's 2025 policy committee who didn't back September's rate cut − on Friday, capping a week of 'hawkish' Fed comments from his fellow policymakers.

"[Jobs market] pressures are more likely to stem from structural changes in technology and immigration policies. However, rate cuts could have a more lasting impact on inflation, as they might increasingly call into question our commitment to the 2% inflation target."

September's non-farm payrolls report, the first major economic release that was delayed by the record 43-day government shutdown, will be released this Thursday, according to the US Bureau of Labor Statistics.

Data for October Personal Consumption Expenditures (PCE), the Federal Reserve's preferred measure of inflation, will then be released on Wednesday next week according to the Commerce Department.

Alongside gold prices, London quotes for silver − which finds nearly 60% of its annual demand from industrial uses − climbed 1.5% to $51.30 per ounce earlier on Monday before paring the most of that gain.

That followed silver's biggest daily fall in over three weeks – a 3.5% drop – last Friday.

The US Dollar meantime edged higher on the FX market while 10-year US Treasury yields edged lower from Friday's 7-session high for Washington's key borrowing cost.

New York stock markets opened the week flat despite AI and tech stocks dropping again, while European bourses edged lower for a 3rd consecutive session.

Gold priced in Euros and UK gold prices in Pounds steadied near last Friday's close at €3094 and £3514 per Troy ounce respectively.

Email us

Email us