Gold, Silver Plunge with AI Stocks, Bitcoin on 'Restrictive' Fed Rates

GOLD and SILVER PRICES plunged on Friday as global stocks and bonds fell in price and cryptocurrencies sank after yesterday's steep sell-off in the USA's AI 'bubble' as hopes fade for a December rate-cut by the US Federal Reserve.

The industrially-useful precious metal lost as much as 7.9% from yesterday morning's near all-time silver price high of $54.39 per Troy ounce, dropping within 10 cents of $50 to show a 2.7% gain from last Friday's finish.

The Dollar price of gold meantime slashed this week's gain from 6.3% to 2.2% as the 'safe haven' precious metal − which hit 1-month highs Thursday at $4244 per Troy ounce − fell as low as $4033 before rallying $50 into London's 3pm auction.

Both metals steadied as New York stock markets opened the day higher, with AI software and data specialist Palantir (Nasdaq: PLTR) cutting its plunge from last week's new record price to 16.3% while AI chipmaker Nvidia (Nasdaq: NVDA) traded 10.0% below start-November's all-time high.

So-called cryptocurrency Bitcoin meantime fell through $100,000 for the first time since May, losing almost 25% from early October's record high while No.2 cryptocurrency Ether also lost 4.9% for the day, down more than 1/3rd from its peak in August.

"Gold's muted response to the equity pullback is raising doubts about its safe-haven role," said a trading desk note from Chinese bank and London bullion clearers ICBC this morning.

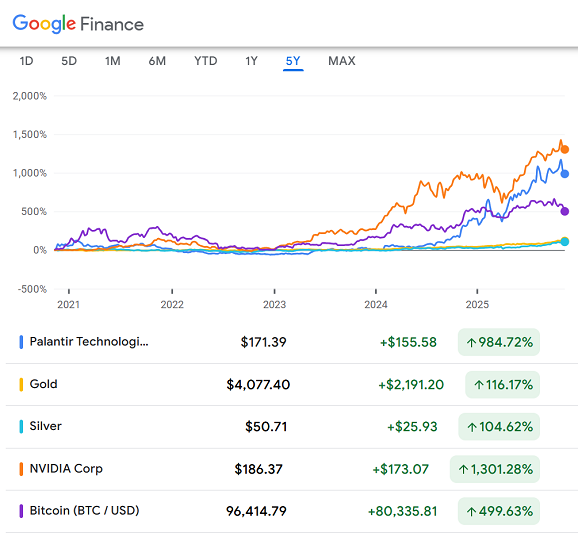

With gold and silver doubling in price from 5 years ago, Bitcoin has risen almost 500% while PLTR and NVDA have doubled that gain again.

"It will likely be appropriate to keep policy rates at the current level for some time," said 2025 voting Fed member Susan Collins in a speech Wednesday, setting "a relatively high bar for additional easing in the near term."

Contrary to Trump appointee Stephen Miran's view, "[There's] underlying resilience in economic activity, more than I had expected," agreed the Minneapolis Fed's Neel Kashkari − a non-voting member of the US central bank's policy committee in 2025 − to Bloomberg overnight, a position backed by fellow non-voters Beth Hammack of the Cleveland Fed and San Francisco's Mary Daly, also calling to keep rates "restrictive".

October's US jobs data − widely expected to show a drop in non-farm payrolls − may now be released next week, but "The Fed will have less data than usual" because of delayed releases following the record-long US government shutdown, says Dominic Pappalardo of investment ratings service Morningstar, "which may complicate the decision-making process."

Alongside global stock markets, Asian and European bond markets fell hard this morning, driving Tokyo's government borrowing costs up towards the highest in 17 years above 1.7% per annum on 10-year JGBs, while London's 10-year Gilt yield leapt to 4.51%, jumping by 12 basis points from Tuesday's new 2025 lows as news broke that Chancellor Rachel Reeves has U-turned on raising income tax in this month's much-anticipated Autumn Budget.

Gold priced in Sterling fell as much as 6.3% from Thursday's peak before steadying just below £3100.

Euro gold meantime erased almost all of this week's previous gain beneath €3467 before rallying to €3500.

Shanghai gold prices traded $21 per ounce below London quotes overnight, the steepest discount in a month and signalling weak demand in the precious metal's No.1 consumer nation following the loss of VAT sales tax offsets for non-investment fabricators.

While jewellery demand will suffer further, the switch in China towards investment gold will continue, say specialist analysts Metals Focus.

"Strong price rallies, gold's growing appeal as a diversification asset, and the PBOC's announcements of gold acquisitions should all provide robust support."

As for US AI spending, "Understating depreciation by extending useful life of assets artificially boosts earnings," said 'Big Short' investor Michael Burry this week, pointing to what he calls "one of the more common frauds of the modern era" as the so-called 'hyperscalers' of AI software "massively ramp capex through purchase of Nvidia chips/servers" leading Meta, Google, Oracle, Microsoft and Amazon to "understate depreciation by $176 billion 2026-2028" on his calculations.

Shorting Palantir through $9.2 million of put options with a strike price of $50 in 2027 against last month's finish at $200 per share, Burry this week de-registered his Scion Asset Management hedge fund.

Email us

Email us