Gold and Silver Drop as Fed Cuts Rates, Bond Yields Rise with the Dollar

SILVER DROPPED and GOLD prices sank almost 2% early Thursday after briefly setting a new all-time high against the Dollar following yesterday's quarter-point cut to US interest rates by the Federal Reserve.

Spiking to $3707 per Troy ounce as the US Dollar plunged on the news, the price of gold then dropped as low as $3634 in late Asian trade today, also erasing this week's previous gains for Euro, UK Pound and Japanese Yen investors.

Silver also spiked on the Fed's rate cut − the first ever Fed policy decision made with a sitting White House official on its Board − briefly trading back at unchanged for this week so far before falling once more towards 1-week lows beneath $41.40 per Troy ounce, down more than $1.50 from Tuesday's new 14-year peak.

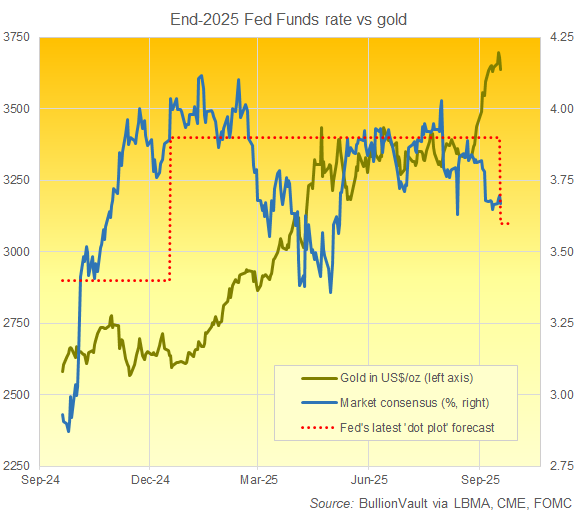

"The labor market is softening...[So] you can think of this, in a way, as a risk management cut," said Jerome Powell after the Federal Open Market Committee he chairs cut overnight US borrowing rates to 4.08% as expected while projecting 2 further quarter-point cuts by year-end in September's 'dot plot' forecasts, also matching futures market consensus bets.

“We have begun to see goods prices showing through into higher inflation," Powell added when asked about President Trump's trade tariffs.

"[But] to the consumer, the passthrough has been pretty small...slower and smaller than we thought."

Fed governor Lisa Cook still in attendance despite Trump "firing" her, new appointee Stephen Miran, currently also Trump's chief economic advisor, was alone in calling for a half-point cut while projecting 2 more half-point cuts by year-end.

"This looks like a gesture more than anything else, and it’s hard to take seriously," says Bloomberg columnist John Authers.

"What really mattered," Authers says, is that Christopher Waller and Michelle Bowman − both named as possible Trump replacements for Fed chair − voted with Jerome 'Too Late' Powell after dissenting in July by calling for a cut when the Committee stayed on hold.

The Dollar rallied on yesterday's Fed news, edging higher from new 3.5-year lows against the world's other major currencies.

US stock markets failed to rise, closing 0.2% below Monday's fresh all-time high on the S&P500, and longer-term US Treasury bonds also fell in price, nudging government borrowing costs higher.

"The rise in very long-term government bond yields is happening everywhere," says Robin Brooks, formerly chief FX strategist at US investment bank Goldman Sachs and now a senior fellow at Washington think-tank the Brookings Institution.

"There's idiosyncratic trouble spots like Japan, France and the UK, but what's playing out is far bigger than that. Fiscal policy globally has been too loose for too long. That has consequences."

"Gold is now the anti-fragile asset to own, rather than Treasuries," says US investment bank Morgan Stanley's chief investment officer Mike Wilson, recommending that investors replace the 60:40 portfolio of stocks and bonds with 60:20:20 in stocks, fixed income and gold.

Email us

Email us