Powell 'Too Late'? Too True

Trump's jibe sticks...

AFTER TRUMP's latest hectoring of Jerome "too late" Powell after the employment report, gasps Gary Tanashian in his Notes from the Rabbit Hole, Jerome Powell appears to have aged markedly.

I swear, Trump's main attribute is his relentless ability to outlast everybody. His stamina and energy are remarkable. The Fed chief, while not relenting to the hectoring, appears to be wearing it. Maybe it's just a trick of the camera. But Trump is a force of nature.

I think the guy doesn't know WTF he is doing in many cases, but he does it anyway and is an immovable object. He's also pretty funny with the nicknames he gives everybody. "Shifty Schiff", "Sleepy Joe", "Crooked Hilary"...

...I have to tell you, as a nickname maker upper myself, it cracks me up. "Too Late" Powell.

Anyway, "ADP NUMBER OUT!!! 'Too Late' Powell must now LOWER THE RATE," Trump wrote on Truth Social.

"He is unbelievable!!!"

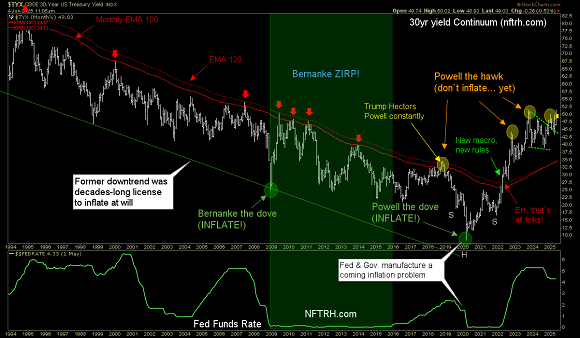

Well Mr.President, we are just now lifting off into a new inflation trade. Powell's not going to drop the rate while the bond market is reacting to that in the direction opposite to your wishes.

Who knows what the trade spanners you've thrown into the works are doing to the inflation dynamic? You harangued Powell in Q4, 2018 while long-term yields were threatening to break out of their multi-decade downtrend. Of course he didn't relent then, either.

But fear not, when we conclude this inflation trade I expect a move in your preferred interest rate direction.

I expect that Powell will again be "too late", as the Fed usually is at important times of change. I could be off base, but I do feel I am seeing the spin on the ball clearly now. Both with respect to the near-term inflation trade (as would be indicated by a continued short-term rise in the Silver/Gold ratio) and to the elements that are going to get a hell of a lot of people in trouble when the trade terminates.

Trump is likely going to get his interest rate cuts. But it will probably be like 2001 and 2007. The T-bill yield continues to diverge the bond market and keep the Fed stiff.

Email us

Email us