Gold Slides into “Healthy Correction” as US–China Trade Progresses

GOLD PRICES dipped further on Monday after the United States and China agreed on a framework for a trade deal, just days before US President Donald Trump and Chinese President Xi Jinping are scheduled to meet, writes Atsuko Whitehouse at BullionVault.

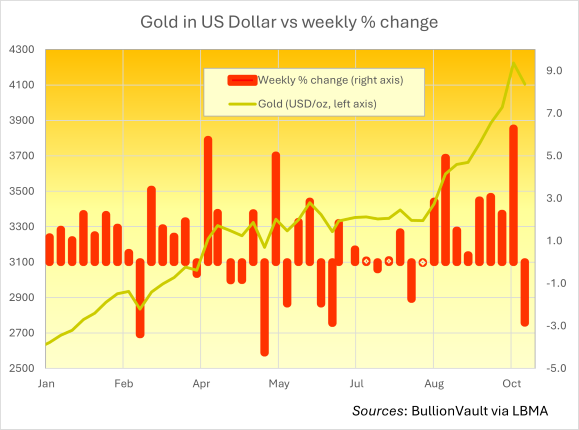

Spot gold fell as much as 2.2% to $4,023 per ounce on Monday, marking its lowest level since last Wednesday. The decline came after last week’s steepest gold drop since April 2013, when the metal had reached a high of $4381 last Monday.

“Gold finally entered a proper correction phase last week after nine consecutive weeks of gains,” said Bruce Ikemizu, chief director of the Japan Bullion Market Association.

The yellow metal dropped 2.8% last week, marking its biggest weekly fall since the week ending 27th June. However, gold bullion had risen 24.1% since the last week of August without any weekly declines - its longest streak of gains since June to August 2020, during the height of the Covid crisis. Bullion remained up 57.3% for the year as of the last session.

“Bull markets always need a healthy correction to weed out froth and ensure the cycle has duration,” echoed Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp.

By last Tuesday, when gold plunged after reaching its recent high, open interest in gold futures and options on Comex expanded to its highest level since September 2024, when prices were setting a series of record highs.

Among gold-backed ETF investment trusts, the giant GLD reduced its holdings on a weekly basis last week for the first time in five weeks. This followed a period in which GLD had added more than 10 tonnes over three consecutive sessions by last Monday — a pace of accumulation last seen in March 2020.

US Treasury Secretary Scott Bessent said the agreement, forged on the sidelines of the Association of Southeast Asian Nations (ASEAN) summit in Malaysia on Sunday, would remove the threat of 100% tariffs on Chinese imports set to take effect on 1st November and would include “a final deal” on the sale of TikTok in the United States.

US President Donald Trump will meet his Chinese counterpart, Xi Jinping, in South Korea on 30th October on the sidelines of an Asian summit, the White House confirmed last week.

Asian stock markets rose on Monday, with South Korea’s KOSPI, Taiwan’s benchmark index, and Japan’s Nikkei all gaining more than 2% and reaching record highs. China’s blue-chip CSI 300 index added 1.19%, while Hong Kong’s Hang Seng rose 1.05%.

Gold prices on the Shanghai Gold Exchange fell 0.5% to ¥932 per gram. They turned to a discount of $0.98 per ounce relative to London prices on Monday, after wholesale bullion in the metal’s No. 1 consumer market recorded a weekly average premium of $3.68 last week - the first since the end of August.

The Dollar Index - a measure of the US currency’s value against its major peers - edged lower on Monday amid expectations of a US rate cut following weaker-than-expected consumer price index data published last Friday. The release had been delayed by nine days due to the partial US government shutdown, now in its 27th day - the second longest on record after the 35-day closure during President Donald Trump’s first term.

Ten-year US Treasury yields - a benchmark for government as well as many financial and commercial borrowings - edged up above 4.0%, despite the odds of an October rate cut at this week’s policy meeting being seen above 96% certainty. Fed rates are expected to end 2025 at 3.64%, according to market consensus, matching the level projected in September’s ‘dot plot’ forecasts.

Gold priced in Euros meanwhile fell as much as 2.4% to €3450, while the UK gold price in Pounds per ounce also declined 2.5% to £3010.

Prices for silver, primarily an industrial metal that finds nearly 60% of its annual demand from industrial uses, also fell 2.5% to $47.39 per ounce. This followed an 11.3% plunge in the previous week, the steepest weekly decline since the global equity crash during the Covid crisis at the end of September 2020.

“Silver remains on the defensive as post-Diwali liquidity in the London spot market continues to improve,” said Ole Hansen, commodity strategist at derivatives platform Saxo Bank, noting that spot prices are back below futures today - a normal structure that reflects funding and storage costs, unlike the tight silver market conditions seen in early October.

Email us

Email us