Gold Bounces from Worst Crash Since 2013 After 'Tourists' Flood In

The PRICE of GOLD bounced for a second time Thursday from its steepest crash in 12 years, briefly topping $4100 per Troy ounce in Asian trade as analysts pointed to technical selling by chart-watching traders following this month's flood of 'tourist' investors.

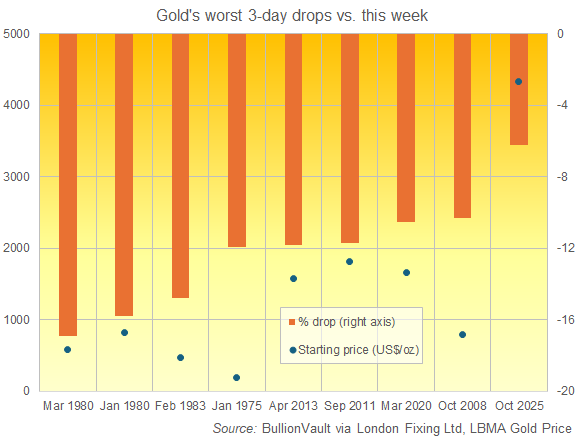

Having already made a record-steep gold drop in Dollars per ounce at the start of this week, London bullion dropped 8.6% between Monday morning's new spot-market peak of $4381 and Wednesday morning's 7-session low of $4004, recording its steepest drop since the gold price crash of April 2013.

That crash cut a quarter off the price of gold inside 3 months, with the 'safe haven' eventually bottoming at $1045 per Troy ounce − down more than 45% from 2011's financial crisis peak − in December 2015.

Basis the daily benchmark auctions in London, the deepest single point of liquidity formerly known as the fixings and now the LBMA Gold Price, the 'safe haven' lost 6.2% between Friday's 10:30am peak and Wednesday's 3pm low, the steepest drop since the Covid Crash in all asset prices of mid-March 2020.

"We think technical selling has been the main culprit," says Suki Cooper, global head of commodities research at UK multinational bank Standard Chartered.

"Gold has been trading in overbought territory since early September...[and] hadn't had chance to test its floor."

"The tipping point? Maybe China," says a trading note from Chinese bank ICBC's bullion team in London, also seeing chart-based selling as the key driver of gold's price slump and noting that Monday's high in Asia "came right around 1,000 Yuan/gram in Shanghai."

This week's plunge in global gold yesterday saw prices in China − the gold world's No.1 mining, importing, consumer and central-bank buying nation − jump to a premium of $14 per ounce over London quotes, twice the typical incentive for new bullion imports.

That snapped the longest and deepest run of Shanghai discounts since the Covid lockdowns of 2020, signalling weak domestic demand versus supply as prices leapt to fresh record highs on a flood of new investment demand.

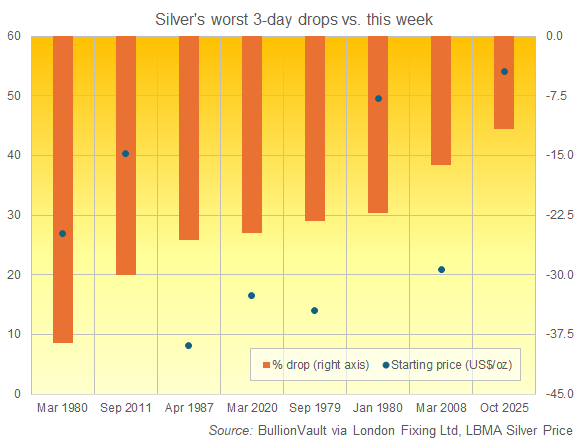

Silver meantime lost 12.7% by Wednesday's spot-market low near $47.50 from Friday's new record high, down almost $7 per ounce and making its sharpest plunge since the Covid Crash.

Basis the London auctions, silver had fallen harder still, down 30.0% across 3 sessions, when gold's post-financial crisis bear market began in September 2011, and it lost 34.2% in 3 sessions around 'Silver Thursday' in March 1980, when US oil barons the Hunt brothers' attempted corner of the silver market collapsed.

Trading volumes in Shanghai gold as well as Shanghai gold futures yesterday hit the greatest level since late-April this year, when gold prices retreated from new all-time highs following US President Trump's 'Liberation Day' trade tariffs shock.

Trading volumes in Comex gold futures and options contracts yesterday leapt to the highest since 12 March 2020, when the start of European and US pandemic lockdowns crushed the price of all assets.

Giant gold-tracking ETF the SPDR Gold Trust (NYSEArca: GLD) meantime shrank Wednesday to need 6.3 tonnes less bullion to back its shares in issue, the steepest 1-day outflow since mid-May.

That followed the longest run of net investor inflows since April 2020 last week took the GLD's backing to 1,058 tonnes, the largest since summer 2022, worth an all-time record value of $146 billion.

October's sudden inflow of "universal investors" who don't typically trade the gold market − more widely referred to as "tourists" within the bullion industry − last week coincided with Diwali-related buying ahead of the key Indian festival, says Cooper at StanChart.

"Flows into gold-linked funds had been breathtaking," says ICBC Standard Bank, noting that ASX-listed ETFs in Australia saw record annual inflows while the stock-market price of Japan's Physical Gold ETF was trading 16% above its net asset value, "underscoring frenzied demand detached from fundamentals.

"As froth turned to fear, heavy margin calls and forced liquidations swept through futures markets, leaving investors flying blind without CFTC positioning data due to the ongoing US government shutdown."

With US President Trump last might imposing new sanctions against Russian oil giants Rosneft and Lukoil after talks broke down with President Putin over seeking a peace deal with Ukraine, the price of silver rallied less than gold, recovering around 80 cents from its October 2025 crash low to trade at $48.30 per Troy ounce.

Email us

Email us