Silver Spike Tops $50 Record, London Squeeze 'Serious'

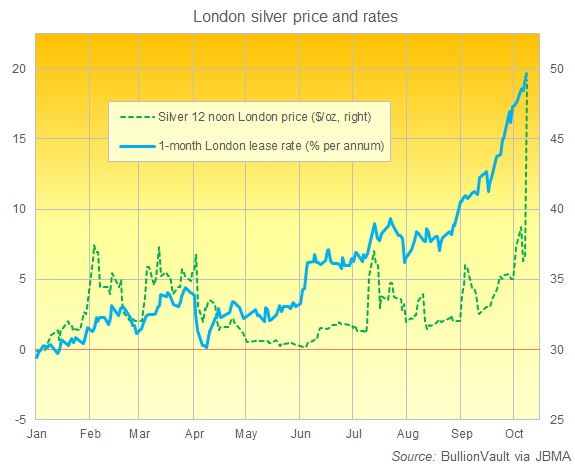

The PRICE of SILVER jumped to new all-time highs above $50 per ounce on Thursday, setting fresh records against all major currencies as lease rates to borrow the metal in London almost tripled to new unprecedented highs, before erasing that spike.

Gold meantime whipped in a $50 range per ounce, failing to beat yesterday's fresh benchmark record in London before also dropping hard to fall through $4000 gold after news of Israel and Hamas signing phase one of the Gaza ceasefire deal proposed by US President Trump.

Finding some 50% of its net demand today from industrial and other productive uses, silver briefly touched $50 per ounce on 21 January 1980 and 28 April 2011, both times followed by steep plunges.

But it had already beaten those highs in 2025 in terms of UK Pounds, Chinese Yuan, Japanese Yen and many other currencies, and September saw the London market set a new all-time high month-average silver price in Dollars.

Rising demand and a deficit of global silver supply saw talk of a "silver squeeze" in London begin as Donald Trump returned to the White House early this year.

Reflecting a scramble for metal, the 1-month lease rate for borrowing silver in London − the world's central trading and storage hub for wholesale bullion bars − almost tripled today from yesterday's already historically high levels to reach more than 19% per annum.

"Silver squeeze is on. This is serious," says former Tokyo precious metals banking director Bruce Ikemizu, now head of the Japan Bullion Market Association.

Silver today fixed at a new 12 noon benchmark high around $49.64 per Troy ounce in London, topping 18 January 1980 by almost 20 cents.

Spot trading then saw silver spike as high as $51.24 per ounce, beating its historic highs by 2.5%, before erasing all of that move as London trading closed, leaving New York's Comex futures market at a discount to spot, suggesting over-supply of bullion in the US and encouraging metal to reverse the record heavy westwards inflows made earlier this year amid Trump's trade tariffs threats and policy confusion.

Alongside strong industrial demand, due in part to China's accelerating pace of solar-energy installations in 2025 according to US investment bank Morgan Stanley, "silver has also seen a surge in inflows to physically-backed silver exchange-traded funds," says Reuters.

Yesterday the giant SLV silver ETF expanded for the 3rd session running, reaching its largest size since end-September's 3-year highs and needing 15,415 tonnes of metal to back its shares in issue.

That's equivalent to more than 7 months of global silver mine output, with the USA's next 2 largest silver-backed ETF trust funds accounting for a further 3.8 months' between them.

For silver prices, "It's getting thin up here," said precious metals strategist Nicky Shiels at Swiss bullion refining and finance group MKS Pamp overnight, looking at the spot market silver price versus the metal's 200-day moving average.

"There have been 10 instances of silver trading more than 30% above" that underlying level, says Shiels.

Historically, all those instances were "short lived", followed by an average plunge of 24% over the follow 2 months, "equivalent [today] to a $11.60 (!) drawdown" beneath $40 per ounce.

Over in China meantime, Shanghai's gold market re-opened Thursday to find London bullion trading almost $200 per ounce higher than when it closed for National Day holidays last Tuesday.

That saw the Shanghai Gold Exchange's benchmark price jump by 4.5% to fresh all-time highs above 911 per gram.

But the discount versus London quotes also widened, reaching the deepest since summer 2020's historic Covid Crisis gap at the equivalent of $62 per Troy ounce.

Email us

Email us