Gold and Silver Rebound as Trump Arrests Maduro, Spooks Nato Over Greenland

GOLD and SILVER PRICES jumped on Monday, rebounding within 2.5% and 9.0% respectively of last week's new record-high spikes as the Dollar and global stock markets also rose after US special forces attacked oil-rich Venezuela to arrest Communist dictator Nicolás Maduro for smuggling cocaine into the USA, writes Atsuko Whitehouse at BullionVault.

With US President Donald Trump then threatening Mexico and Colombia over illegal drug flows, as well as Communist Cuba and Iran's Islamist dictatorship, the prime ministers of both Greenland and Denmark called on Trump to stop his "fantasies" of annexing the Danish-owned resources-rich Arctic island, comments echoed by Denmark's fellow Nato member nations across Europe.

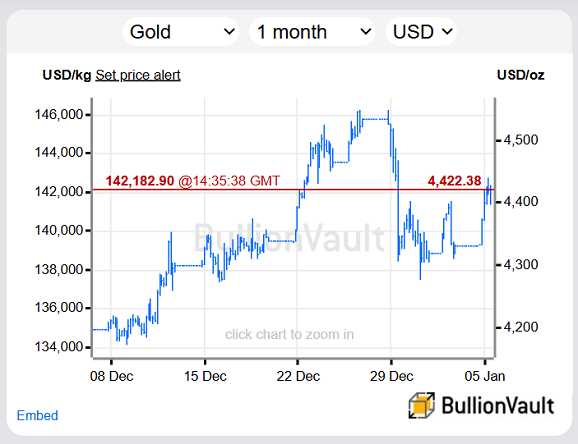

Spot gold prices rose as much as 2.3% to $4433 per Troy ounce, while the price of silver bullion in London surged as much as 4.7% to $76.30 per ounce before paring the half of the gain.

"Markets are now forced to reprice not just Venezuela [and therefore] emerging markets and Latin America risk, but also US unpredictability, military reach and political will," says Nicky Shiels, head of metals strategy at Swiss bullion refining and finance group MKS Pamp, after Trump said "We need Greenland for a national security situation...It's so strategic."

While the weekend capture and today's arraignment in New York of Maduro "hasn't caused major disruption, rising political and geopolitical uncertainty in Latin America could drive increased demand for haven assets," says Yuxuan Tang, a global market strategist at US financial giant J.P.Morgan Private Bank.

The Dollar index – a measure of the US currency's value versus its major peers – rose 0.3% to a 1-month high as the price of gold reversed a quarter of Monday's initial jump.

"If they don't behave, we will do a second strike," Trump said late on Sunday as he returned to Washington from Florida, threatening Maduro's deputy Delcy Rodríguez, now de facto leader of Venezuela − which has seen its remaining gold bullion reserves frozen at the Bank of England for at least 7 years − that she would "face a situation probably worse than Maduro" if she does not run the country as the US President wishes.

The price of oil − of which Venezuela holds the world's largest crude reserves but produces less than 1% of global output thanks to exports constrained by US sanctions and a naval blockade − fell near a 5-year low before paring that loss at the start of Monday's trading, with Brent crude declining as much as 1.3% and West Texas Intermediate falling 1.1%.

In contrast, shares in Chevron, ConocoPhillips and ExxonMobil jumped after Donald Trump said that large US oil companies would invest in Venezuela.

European stocks touched record highs, climbing as much as 0.6% on the region's EuroStoxx 600 index, while European defense stocks jumped 3.3% as a sector to a 3-month high.

Ten-year US Treasury yields – a benchmark rate for government as well as many finance and commercial borrowing costs – edged lower from a 4-month high after 2026 Federal Reserve voting member Anna Paulson of the Philadelphia Fed said "modest" interest-rate cuts could be appropriate later this year.

But the risk of long-term fiscal dominance in the USA − with the Treasury over-riding the central bank's independence to keep borrowing costs low − is rising as government debt continues to mount, says former US Treasury Secretary and Federal Reserve Chair Janet Yellen.

Today gold prices on the Shanghai Gold Exchange held at a small premium of $5 per ounce to London prices, snapping two months of signalling weak demand in the precious metal's No.1 consumer nation as Yuan prices returned from the New Year holiday to fall from last week's new record highs.

Platinum, which finds two-thirds of its demand from industrial uses led by auto-catalysts, rose 2.7% on Monday after falling 4.2% last session when US derivatives exchange the CME Group raised margin requirements on gold, silver, platinum and palladium futures for the second time in a week following the Christmas chaos in precious metals price volatility.

Platinum climbed 121.8% last year to mark its best annual rise ever recorded.

Both gold and silver recorded their best annual price performances since 1979 in 2025 at 65.0% and 149.1% respectively.

Palladium prices today rose back above $1700 per ounce, a near 3-year high when hit just before Christmas, after jumping 72.4% last year.

Email us

Email us