Gold, Silver Soar with Stocks as Record-Bad Consumer Sentiment Spurs Shutdown Deal

GOLD and SILVER PRICES soared on Monday, briefly topping $4100 and $50 per ounce respectively as global stock markets also jumped after US politicians moved to end the 6-week government shutdown amid the worst consumer sentiment ever outside the post-pandemic inflation of 2022, writes Atsuko Whitehouse at BullionVault.

"It looks like we're getting closer to the shutdown ending," President Donald Trump told reporters Sunday evening after a group of Democratic lawmakers crossed party lines to back a compromise plan for new departmental funding to end the record-breaking shutdown of government services.

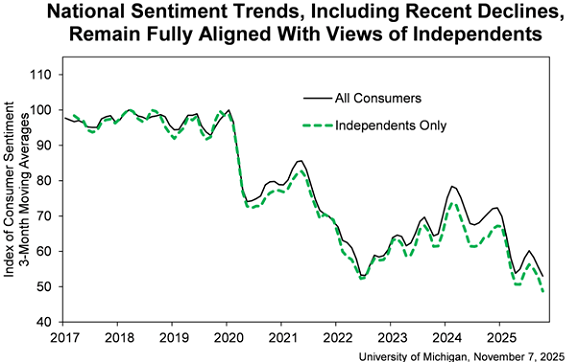

Still needing to pass both the Senate and the Republican-controlled House of Representatives, the deal followed Friday's US consumer sentiment data from the University of Michigan, which put confidence below the lows of 1980, 2008, 2011 and 2025 to date.

Led by sharp drops in personal finances and business expectations, the plunge in sentiment affects all consumer groups, the Michigan survey says, with independent voters slightly more negative again.

"Gold and silver have started the week in a feisty mood, both rallying as markets weigh signs of US economic weakness against progress toward ending the government shutdown," says derivatives platform Saxo Bank's Strategy Team.

Spot gold in London's bullion market jumped as much as 2.6% to a 2-week high of $4105 per Troy ounce, trimming its decline from mid-October's all-time gold price high of $4381 to 6.3% and putting the 'safe haven' precious metal's year-to-date gain at 57.4% in US Dollar terms.

The price of industrially-useful silver also leapt, rising as much as 3.9% to $50.21 per Troy ounce − a near 3-week high − cutting its recent loss to 7.8% from last month's record peak of $54.47 and putting silver's gain so far in 2025 at 73.7%.

"With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy," said Joanne Hsu, Director of the Surveys of Consumers at the University of Michigan, of Friday's data release.

"The economic impact of the US government shutdown is far worse than expected" said White House economic adviser Kevin Hassett, citing slowing construction projects and a decline in travel activity.

With the peak travel season of Thanksgiving now barely 2 weeks away, the Federal Aviation Administration has ordered airlines to begin reducing flight numbers as more air-traffic controllers opt not to work without pay checks.

Global redundancy services firm Challenger, Gray & Christmas meantime said planned job cuts in the USA have risen to the highest level since the Covid Crisis of 2020, while hiring plans have fallen to the lowest level since the financial crisis recession of 2009.

With official non-farm payrolls estimates now missing since the shutdown hit the Bureau of Labor Statistics on 1st October, "The growing data void has lifted uncertainty premiums, supporting gold prices as investors hedge against both political and economic risks," says the trading desk at Chinese-owned London bullion bank ICBC Standard.

It took as long as 6 weeks after the previous record-longest shutdown ended for most US official statistics to be fully updated and return to their normal release schedule during the first presidency of Donald Trump.

Gold priced in Euros meanwhile climbed 2.6% to a 2-week high above €3548 per ounce on Monday, while the UK gold price in Pounds per ounce jumped 2.5% to trade above £3114.

With Asian stock markets gaining 0.9% today on the MSCI Asia Pacific Index, European bourses also advanced, with the pan-European Stoxx 600 rising 1.5%, on track for its biggest 1-day gain since June.

Email us

Email us