Bitcoin Isn't Gold. It's Silver

- It's got a storming story – new technology, China, mass adoption, the future, you name it;

- Scarcity is guaranteed (kinda), with a huge shortage certain to hit;

- Price gains are dramatic, slaying all 'traditional' assets;

- Forecasters across the web predict five, ten, even 100-fold gains from here;

- It isn't used as money (not much anyway). But cheerleaders say it will be soon;

- So buy now and build untold purchasing power while you still can...

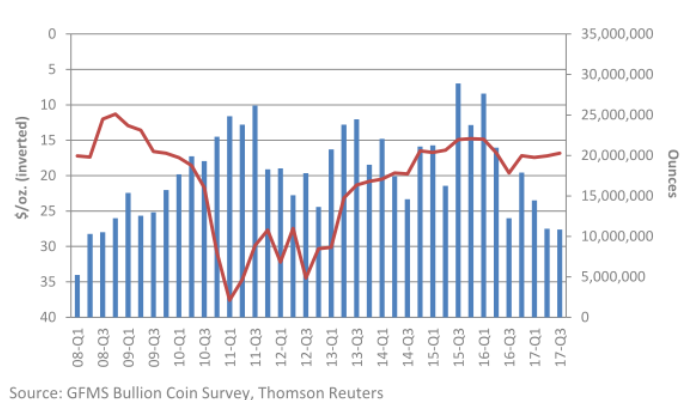

- Who could forget the "Outrageous Silver Speculation [of] $200 or $400?!?" from late 2015? (The metal was then bottoming around $14 per ounce. It's just below $17 today.)

- Or what about "The Silver Chart Predicting $200 Silver by 2018" from February 2013? (It was then falling through $30 per ounce.) "Parabolic Up-trend Channel Suggests Massive Silver Move is Imminent." (Not quite. Silver was about to sink faster than gold in the crash of April-June 2013, down by one-third in 3 months.)

- Or better yet, how about "$200 an Ounce Silver? Can it Happen?" from June 2004? (Silver was then breaking up through $6 per ounce.)

"Bitcoin bulls had a lot of explaining to do in the early years. [We] will skip over some of the arguments early bitcoin evangelists had to make...because these arguments are boring. The panel will [instead] debate outlooks for the asset class, what’s behind the current bull run, and the existing obstacles that could keep bitcoin from rocketing to the moon."

"Many of these new participants are still learning."

Email us

Email us