'Safe Haven' Gold Sinks as Silver Plunges: What Next?

Crash or correction, gold and silver buying matches selling so far...

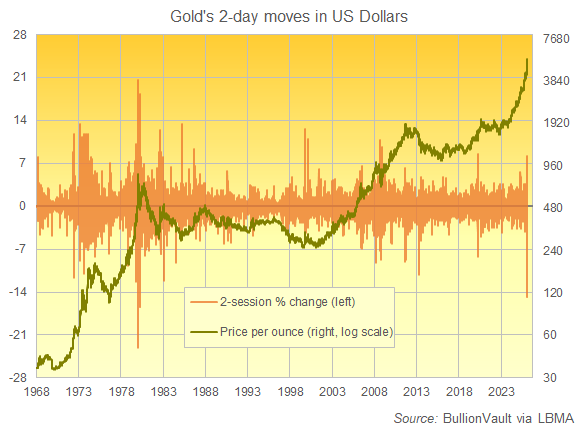

GOLD has fallen 14.9% in US Dollars since Thursday's all-time high, its 3rd steepest plunge in history, says Adrian Ash at BullionVault.

Silver has meantime made its second steepest-ever 2-session drop, down 30.0%.

What happens next? Anyone tells you they know, they're lying at best.

But people tend to buy gold as investment insurance, hoping that it will perform well when other things do badly. Yet there are times when 'safe haven' gold can feel very unsafe indeed.

The killer inflation of the 1970s saw gold prices rise 20 times over, and ended with gold spiking to $850 per ounce in January 1980. The price then crashed, and kept falling until the year 2000. Gold didn't break its 1980 high until 2007.

The Tech Stock Crash and financial crisis then saw gold rise 7-fold during the 2000s, surging to $1920 in autumn 2011 before falling hard and crashing in spring 2013. Gold didn't recover its peak until the Covid pandemic in 2020.

Here in 2026, the breakdown in global trust and cooperation has driven gold and silver prices three times higher over the past five years. Given what's happening in geopolitics, it's hard to see that underlying bull market reversing course. The New Year's spike clearly put gold and silver way ahead of their uptrends, but this historic price drop has only taken them back to what were new record highs this time last month.

That said, no one knows where prices will go from here, and if the action in precious metals prices is causing you concern, you might want to consider the size of your holdings. Gold is supposed to reduce your losses during a financial crisis. Anyone who fears that gold could put their own finances at risk should review their allocation.

Whether a correction or a crash, trading on BullionVault has leapt to fresh records, with Saturday and Sunday − when coin shops were shut and bullion-backed ETFs were closed along with the rest of the stock market − setting a new weekend high of more than $27 million changing hands in gold, silver, platinum and palladium.

Buyers' demand continues to match investor selling. Because one person's profit is another's chance to buy at much cheaper prices.

As for the cause of gold and silver's plunge, some blame last week's sudden panic in tech shares spooking investors into selling their more profitable positions to cover losses. Others think President Trump picking Kevin Warsh as Fed chairman means he's given up trying to crush interest rates and chosen a 'hawk' instead.

Almost as crazy as that, some even claim that the price drop is manipulation − some kind of conspiracy to cap gold and silver prices to avoid a global financial crisis. Yet nobody blamed bullion banks or the financial authorities for 2025's near-record jumps or the January 2026 spikes to untold record highs. And even amid this price drop, the 'hard money' metals also remain the best-performing assets of the 21st century by far. That would make any 'suppression' scheme − if ever it existed − an utter failure anyway.

Long story short? The market got very hot, very quickly. Now it's pulled back faster still. Active traders and new buyers will find it a gift. Long-term owners will find their profits back where they were less than a month ago.

Email us

Email us