Gold and Silver Shine in Trump's New World Disorder

How the Donroe Doctrine plays for precious investment...

SAID IT before, going to say it again, says Adrian Ash at BullionVault.

Gold tends to do well when other investments do badly...

...but it does best when people lose faith that they know how the world works.

And since Donald Trump returned to the White House a year ago next week, investors and savers the world over have felt the ground shift beneath their feet.

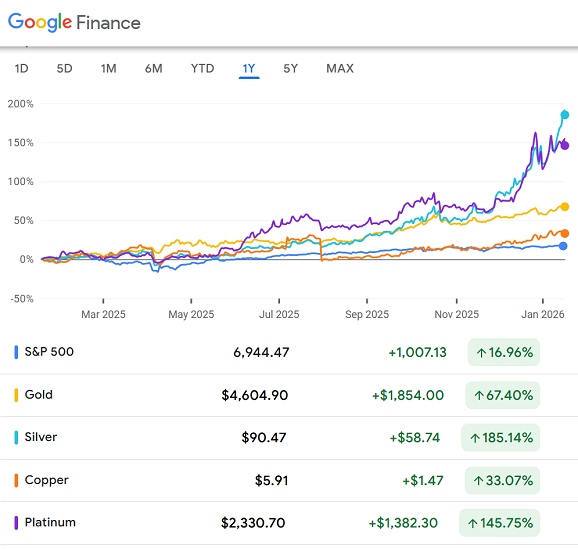

Oh sure. Global stock markets have also hit fresh record highs since Trump came back.

So too has copper, the base metal "with a PhD in economics" because of its correlation with GDP growth.

But love him or loathe him, the 47th President has ripped up the rules over the past 12 months in pretty much every sphere you can name.

Cue the strongest annual gains in gold and silver since 1979, plus a record modern-era rise in platinum, also hitting fresh all-time highs. Now they've gone vertical again as 2026 begins as Trump says and does stuff no-one could have guessed possible.

"Price controls, interest rate caps and the dilution of central bank independence," notes one financial pundit of Trump's social-media announcements and legal attack on the Federal Reserve.

"Funny how these are now suddenly policies of the 'right'."

"Capitalism for you. Socialism for them," says another pundit pointing at the US oil giants demanding guarantees from Trump before they risk investing in Venezuela.

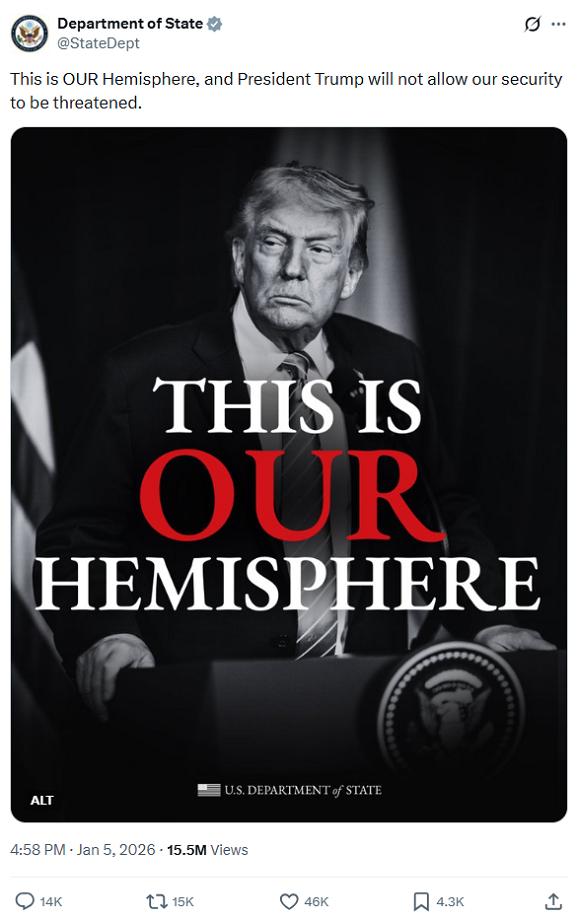

"This is old-style colonialism," says yet another bedwetter following the US kidnap and arrest of all-round bad guy Nicolas Maduro.

"The Belgians did not benefit from King Leopold looting Congo. Are Americans really so naive that they buy this nonsense?"

"Instead of lending out dollars to banks," says another, "the Federal Reserve should lend out Jerome Powell's spine to Republican senators..."

...a spine which, suddenly, a few Republican lawmakers may have found for themselves after the Trump administration began that criminal investigation into the Fed and its chairman.

As for immigration officers shooting dead "a deranged leftist" or the other "nonstop media frenzies", well, "You can agree or disagree with policies," says one self-declared 'libertarian' in a bowtie.

"But the core challenge to the deep state is the undeniable big theme...The future of the US and the West generally depends on the results."

Lots of other apparently sensible people also think Trump is just what America and therefore the world really needs.

"Ultimately, this isn't collapse," says one. "It's correction. And we're only just getting started."

Whatever you think of the new White House, precious metals love Donald Trump.

Last year saw gold and silver rise the fastest since 1979. But that year was a true outlier amid double-digit inflation, the Soviet invasion of Afghanistan and the Iranian hostage crisis. So the more relevant comparison may be the early 1970s...

...when gold repeatedly rose by more than 50% per year as the 'Nixon Shock' of abandoning the Dollar's fixed value in gold upturned international norms, confidence and alliances.

Wanting to seize Greenland though. That's above and beyond anything Tricky Dicky ever dreamt of.

By redrawing the globe into US, Chinese and Russian spheres of influence, Trump accepts the way that dictators Xi and Putin see things. Albeit with a push to "fix" the far-off Middle East too, of course.

Put another way, Trump's new world disorder − aka the Donroe Doctrine − favours military powers who have long been hoarding gold as a symbol (and tool) of independence and strength. And with central banks everywhere seeking an anti-Dollar and indeed anti-West asset to underpin their reserves, sovereign gold demand continues to put a solid floor beneath gold's underlying uptrend and, by extension, the uptrend in the high-beta precious metals too.

But 2025 showed that it takes private investment demand to really send bullion prices soaring, more than offsetting the collapse in consumer jewellery buying.

The start of 2026 says the same. Because for better or worse, the ground keeps shifting beneath our feet...

...and the "barbarous relics" of pre-modern money have made a dramatic return, confirming yet again their No.1 status as the best performing assets of the 21st century by far.

Email us

Email us