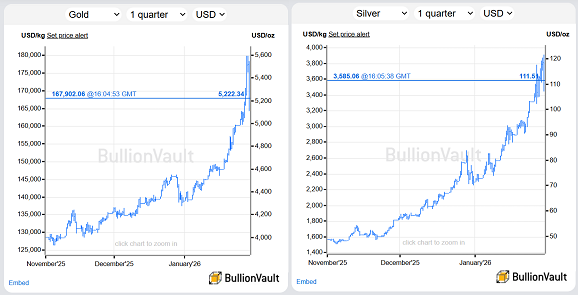

Gold Crash! Down $3.4 Trillion as Silver Sinks 12% from New Record Highs

GOLD and SILVER SANK from fresh record prices on Thursday, with a crash in the 'safe haven' knocking it almost $500 per ounce lower to $5100 as the industrially-useful precious metal plunged by 11.9% amid a slump in major US AI and tech stocks, led by a crash in Microsoft (Nasdaq: MSFT).

The world's largest software company dropped a quarter-billion-dollars of market cap at the New York opening, crashing by 11.9% after quarterly earnings showed a slowdown in its Azure cloud computing and AI data segment.

But with gold peaking Thursday just $5 per ounce beneath $5600, the precious metal's 8.7% plunge knocked $3.4 trillion off the value of all the gold now estimated to be above ground.

Finding ever-more demand from AI computing and green-energy tech meantime, silver peaked above $121 per Troy ounce − more than 68% higher across January, silver's strongest ever monthly gain outside December 1979 − before sinking to $107 as cloud-computing and data giant Oracle sank 5.4% (NYSE: ORCL) on worsening fears that the AI bubble is about to crash, with chipmaker Nvidia (Nasdaq: NVDA) losing 2.7% at the open.

A rally in both precious metals then put them back at what was a new all-time high on Monday for silver and Wednesday for gold.

"The problem is volatility feeding on itself," said commodities analyst Ole Hansen at derivatives platform Saxo Bank after this morning's new gold and silver highs.

"As price swings intensify, liquidity thins. Banks and market makers struggle to [manage] risk [and] when their willingness to quote prices in size fades, liquidity deteriorates and volatility blows out."

"Banks don’t have infinite balance sheets to trade precious metals," agrees Simon Biddle, head of precious metals at broker Tullet Prebon.

"Trading volumes have decreased as they are taking less risk.”

Trading volume in the giant GLD gold ETF yesterday jumped to the heaviest since gold's late-October jump through $4000 per ounce.

Silver ETF volumes in contrast saw a further retreat from Monday's record SLV trading levels, and volume in Comex silver futures also fell for the 2nd day running.

But trading in Comex gold futures rose Wednesday after dropping from Monday's 3-month high.

Base metals also sank after leaping to new all-time highs on the sudden easing of financial rules for real-estate developers in China, while crude oil fell from a 6-month high hit amid rumors that the US Trump administration is about to attack Iran and spark "regime change" revolution.

The US Dollar today edged higher from this week's sudden DXY plunge to 4-year lows.

Email us

Email us