Record Trading in Silver Sends Price to New London and China Highs

GOLD and SILVER PRICES slipped on Tuesday after both precious metals recovered last night's steep drop from fresh record highs, struck above $5000 and $100 per ounce on surging trading volume.

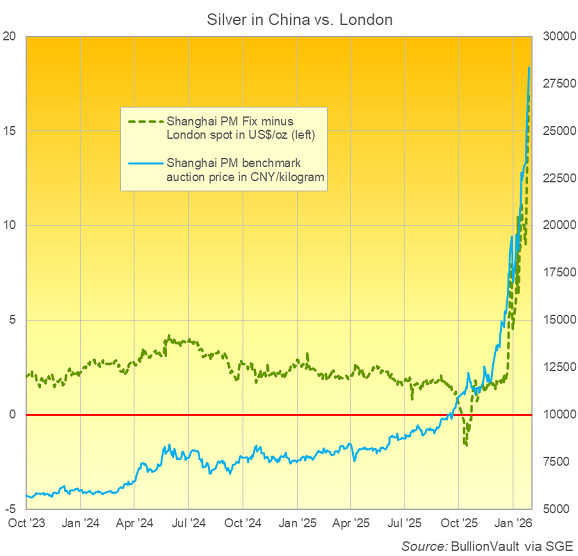

Silver in Shanghai set a fresh all-time high, fixing at ¥28,346 per kilo for a year-to-date jump of 66.7% since New Year's Eve for investors in China.

Silver bullion then set a new benchmark high in London, fixing at midday above $111 per Troy ounce, before edging down to $105 in spot market trade.

Monday night saw silver prices plunge more than $15 per ounce − its entire 1-ounce price as recently as May 2020 − from a fresh spot-market high above $117.

Rising 54.6% so far in 2026, the benchmark silver price in London − centre of the world's precious metals trading and storage network − today extended silver's fastest 1-month gain since the Hunt brothers attempted corner peaked in December 1979, making its 11th new daily high in 18 sessions in 2026 to date.

But China's benchmark silver price was equivalent to almost $17 per ounce more than London's on Tuesday, indicating strong domestic demand versus supply in the precious metal's No.2 mining and export nation.

"Investors are driven by a fear of missing out," says Bloomberg News, "and are using silver as a substitute for gold and a macroeconomic geopolitical play, with physical demand remaining a crucial driver."

While industrial use of silver accounts for almost 60% of its demand, the precious metal "exhibits high volatility driven by its monetary attributes and short-covering pressure," says China's Securities Times.

"Its upward trend is not yet over."

Shanghai gold also set a new record fix at ¥1143 per gram today, but London gold fixed 0.8% below Monday's new 3pm record, clearing the greatest volume of buy and sell orders around $5050 per Troy ounce.

Trading in the Western world's giant iShares Silver Trust (NYSEArca: SLV) was 3 times greater on Monday than the prior 1-month average, setting an all-time record by size on record turnover by value of $38.2 billion.

That very nearly matched Monday's trading value in the S&P500 stock index's SPY ETF, and it equalled more than 2/3rds of the SLV's total net asset value as of Monday's close.

Trading volume in options contracts on the SLV ETF leapt Monday as well, overtaking the number of options contracts traded on the SPY.

Comex silver futures trading meanwhile set a 6-year high by volume and a record by value at $208.5bn yesterday.

Chinese fund managers UBS SDIC today closed the Silver Futures Fund LOF to new buyers, citing a need to protect investors from its "significant premium" to the ETF's net asset value after repeatedly suspending trading in China's only pure-play silver ETF.

Email us

Email us