$5000 Gold Beats 1999 Central Bank Shock, Silver Strongest Since Hunt Brothers' Corner

GOLD and SILVER leapt to fresh record prices above $5,000 and $110 per ounce on Monday, both on track for their strongest monthly gains in well over 4 decades, writes Atsuko Whitehouse at BullionVault.

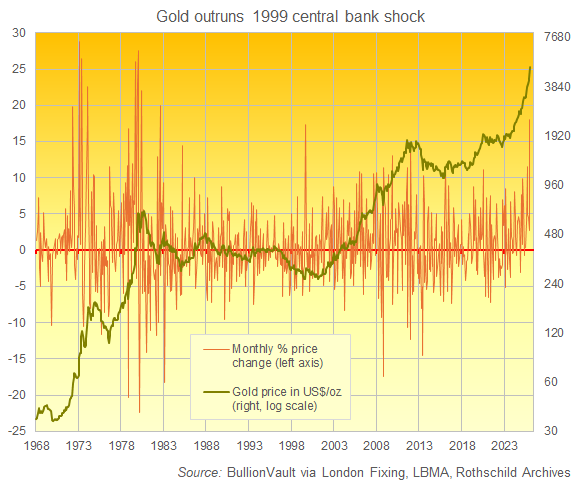

Now rising for a record 8th month in a row, the gold price in US Dollars has jumped by 18.1% since New Year's Eve.

Topping $5000 gold today, the 'safe haven' precious metal leapt by 17.3% in September 1999 when European central banks agreed to cap and co-ordinate future gold sales spurring a shock rally in gold after they had shrunk their bullion reserves at the lowest prices in two decades.

Before that, gold rose 20.0% in August 1982 as the US Federal Reserve slashed its target interest rate to try stemming a deep economic recession amid a plunge in the US stock market.

Silver has meantime risen by 52.1% so far in January 2026, almost twice the pace of April 2011 and its strongest monthly jump since December 1979, eve of silver's first $50 top when oil barons the Hunt brothers' attempted corner of the silver market peaked and collapsed.

"The latest catalyst is this crisis of confidence in the US administration and US assets," says one analyst to Reuters.

"That was set off by some of the erratic decision-making from the Trump administration last week."

With gold and silver also setting new all-time highs in all other currencies today, the Dollar hit new 4-month lows on its DXY index as traders speculated that the central bank and fiscal authorities in Tokyo are preparing to intervene in the currency market to boost the Yen, potentially with US involvement.

US President Donald Trump meantime threatened a 100% tariff on imports from Canada if it agrees a trade deal with China, while US Democratic leaders threatened to block a massive spending package this week, increasing the risk of another US government shutdown, after ICE immigration officers shot dead another protester in Minneapolis.

"If markets interpret coordination [between Tokyo and Washington] as a willingness to tolerate easier global Dollar conditions, especially alongside a dovish Fed, that could reinforce short-term Dollar downside," says an analyst to Bloomberg.

The US currency fell as much as 0.5% to a four-month low after dropping 1.6% last week, marking its biggest weekly decline since May after the US leader first threatened new 'Greenland trade tariffs' on America's NATO allies before abruptly backtracking on the idea.

The Japanese Yen today strengthened almost 1.0% against the greenback following Friday's volatility, when the central banks in Tokyo and Washington apparently made co-ordinated 'rate checks' in the FX market, asking major dealers for quotes in what some traders view as preparation for direct intervention in buying and selling currency.

Silver's strength today pushed the Gold/Silver Ratio – which tracks the two formerly monetary metals' relative prices – down further to 46, the lowest value for gold versus silver since September 2011.

Ahead of the US Federal Reserve's first 2026 policy meeting this week, betting in the futures market now puts the odds of 'no change' in January's Fed decision at 97%, but with 2 rate cuts foreseen by the end of 2026, according to the CME's FedWatch tool.

The US central bank's own 'dot plot' forecast from December indicated just one cut of 25 basis points this year. President Trump is due to announce his pick for the new Fed chairman as soon as this week, replacing Jerome 'Too-Late' Powell, who now faces criminal charges and whose term leading the US central bank ends in May.

"What's happening in Minnesota is appalling and unacceptable in any American city," Senate Democratic leader Chuck Schumer said on Saturday after a US Border Patrol agent shot and killed Alex Pretti, a 37-year-old American intensive care nurse.

"Because of Republicans' refusal to stand up to President Trump," said Schumer, "the Department of Homeland Security bill is woefully inadequate to rein in the abuses of ICE" − meaning that Democrats won't back a new government funding deal ahead of the 30th January deadline needed to avoid a shutdown.

Gold rose nearly 7.0% during the last US government shutdown, which began on 1st October 2025 and lasted 43 days, making it the longest in US history.

Email us

Email us