1971: High Noon for Gold-Backed Money

How Tricky Dicky shot the gold standard dead...

AMERICA's love of TV Westerns nearly kept the US Dollar on a gold standard on Sunday 15 August, 1971, writes Adrian Ash at BullionVault in this little bit of history first relayed to clients receiving the Weekly Update emails.

But which Western TV show?

Roger Lowenstein, writing to mark the 40th anniversary of the 'Nixon Shock' in 2011, said it was Gunsmoke.

Herbert Stein, writing his book Presidential Economics in 1984, said it was Bonanza.

Given that Stein was part of the team which actually came up with Nixon's plan, his version has stuck...

...a claim repeated by Peter Bernstein in his 2000 classic The Power of Gold, as well as by Daniel Yergin and Joseph Stanislaw in The Commanding Heights three years earlier...

...and then repeated by hacks and historians from The Atlantic to Forbes, HistoryToday to yours truly until he bothered to check.

Thing is, the internet says that neither TV show offered much risk to Richard Nixon's infamous TV announcement of 50 years ago two weeks next Sunday.

Gunsmoke, then the 4th most watched show on network TV, actually went out on Monday evenings.

And just like Bonanza...

...which had already sunk to 20th most popular show after dominating US ratings a decade earlier...

...but which was indeed being shown on Sunday nights on NBC that summer...

...it must have been a repeat.

Because the latest seasons of both TV Westerns had ended in April. Neither would launch their new season until September.

Either way, Richard Nixon was nervous of upsetting the public by interfering with their favourite Sunday night viewing.

"The public relations aspect was paramount," wrote Lowenstein in his 2011 look-back.

And as US central-bank chief Arthur Burns would write in his diary a short while later, "I am convinced that the President will do anything to be reelected."

The world learnt the truth of that fear in 1974, when Nixon quit the White House in disgrace after the Watergate plot was uncovered, revealing phone-taps and break-ins against opposition Democrat Party staff in the 1972 campaign.

Such ruthlessness had in summer 1971 plotted to juice the US economy.

Nixon was obsessed with the idea that a recession...which he blamed on the Federal Reserve raising interest rates...had cost him and the Republican Party the 1960 election against handsome war-hero (and East Coast-elite insider) John F. Kennedy.

Now Nixon was in charge and he wanted to stay in charge at the White House. So he wanted to borrow big and spend even bigger, just like the 'monetarist' theory of favourite economist Milton Friedman suggested.

That meant monetary policy had to hang loose as well...

...allowing the money supply to inflate as debt and credit grew.

Trouble was, US money inflation wasn't entirely a US decision.

On the contrary, the Bretton Woods agreement...which had secured America's financial dominance since World War Two...only kept it in the No.1 spot because every other country had to peg their currency to the Dollar...

...and the Dollar was pegged to (and redeemable for) gold at $35 per ounce.

That put a limit on the number of dollars Nixon and his team could spew out.

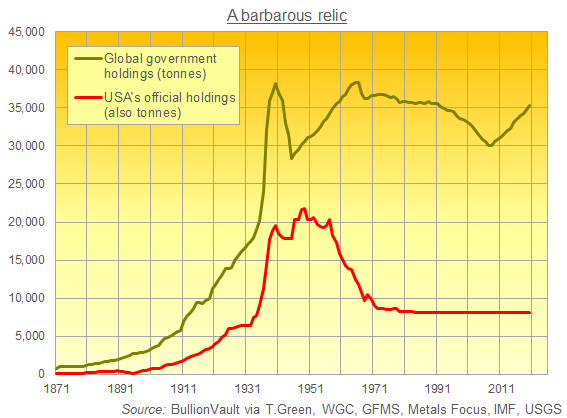

Because the US reserves of gold were limited. And shrinking!

This gold problem had been stewing like a big pot of beans pretty much since 1950.

That was when the Korean War saw the US start spending heavily, churning out dollars to keep the Red Menace at bay.

Come 1960, the US recorded its first trade deficit of the 20th Century, sending more dollars abroad to pay for goods and services than it earned on its own exports.

That year also saw US Dollar holdings overseas outweigh the value of US government gold reserves, then priced at $35 per ounce.

What if the US raised the gold price? That would solve the problem. But it would also hurt America's foreign creditors, because it would devalue the Dollar.

It would also reward anyone who bought gold now. Which lots of people decided to do.

Gold rose in London to $40 per ounce in October 1960, jumping $3 on Thursday the 20th alone amid worsening tensions with the Soviet Union over both Cuba and Eastern Europe (Khrushchev's shoe) plus strong polling for Democrat (and therefore big-spending) presidential candidate Kennedy.

American investors led the gold rush, at least according to a Congressional report on the crisis.

"Gold bars and coins can be acquired as easily in Switzerland as groceries in a supermarket," it gasped.

"During the hectic days of October 1960...more than 50% of Swiss buying orders were of US origin."

What to do?

To stem gold's rise, the US shipped extra supplies of gold to the Bank of England, ready for sale.

Eight major nations then agreed not to encourage more speculation. They would not buy gold anywhere for more than the fixed price of $35.

But they could still take gold off the US Treasury for $35 per ounce.

That was the corner-stone of the post-war Bretton Woods agreement. It aimed to avoid a repeat of the pre-war global depression by making the US Dollar a replacement for gold.

To achieve that, the system promised that the Dollar could be swapped for gold. Which worked just fine for as long as no-one was drowning in dollars and no-one wanted gold instead.

Enter the bad guys, complete with moustaches and black hats...

"What the United States owes to foreign countries it pays, at least in part, with Dollars that it can simply issue if it chooses to."

So spat France's President Charles de Gaulle in a landmark press conference in February 1965.

"This unilateral facility contributes to the gradual disappearance of the idea that the Dollar is an impartial and international trade medium.

"It is in fact a credit instrument reserved for one state only."

Put another way, as French prime minister Georges Pompidou did later that year, "The international monetary system is functioning poorly, because [the USA] can afford inflation without paying for it."

To right this wrong (and also maybe to get ahead of a US devaluation) France began demanding gold from the US in exchange for some of its fast-growing pile of dollars.

Never mind that those dollars helped oil the wheels of international trade and finance as the post-war recovery spread across the Western world.

Never mind that dollars were piling up in Paris because the US was buying ever-more French wine, cheese and other high-value exports.

And never mind all those US troops stationed in Europe as a deterrent against Soviet invasion, spending money as they secured peace and stability.

Germany accepted that trade-off. Threatened by a possible US withdrawal from the Rhineland, Germany agreed not to swap any of its Dollar Mountain for gold.

But other nations joined France in "repatriating" a little of the gold which, under the Bretton Woods deal, they could say that the USA owed them.

"The last straw," writes Peter Bernstein, "came during the week of 9 August, 1971.

"In a note of extraordinary irony, the British economic representative [to Washington] came in person to the Treasury and asked for $3 billion in gold."

Cue Nixon to gather his posse at the ranch...

The President flew in secret to his presidential hideaway at Camp David on Friday 13 August, ordering his economic team (and his speechwriter) to join him without telling anyone else where or what they were up to.

Dashing between the log cabins...but speaking to the President mostly by phone as he stayed inside his private digs, the Aspen Lodge...they thrashed out a plan to curb domestic inflation, then running at 6% per year, with a 90-day freeze on prices and wages.

They would also stop giving foreign governments gold bullion in exchange for dollars.

"[But] Nixon demurred," says Bernstein's Power of Gold.

"He hesitated to make his speech on Sunday evening for fear of irritating the public by pre-empting Bonanza, one of the most popular programs of the era."

Tricky Dicky's advisors won out however, and convinced him to go ahead before the Asian markets opened on Monday morning.

The rest is history.

We are still living through it 50 years later.

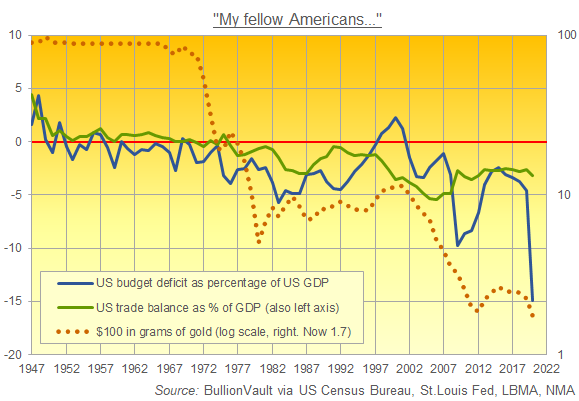

The USA had flirted with trade deficits before the Nixon Shock.

Now it has run a trade deficit with the rest of the world pretty much ever since...

...buying more than it sells in goods and services...

...and exporting ever-more piles of US dollars and debt to cover the gap.

The US government has also run a budget deficit pretty much non-stop too...

...spending more than it collects in tax year after year after year...

...and again, racking up debt in the very same US dollars which it alone can create at will.

Lots of people think this doesn't matter much today.

Lots of others do however, and lots more thought it was the end of the world on the morning of 16 August, 1971.

"What a tragedy for mankind!" wrote Arthur Burns, then head of the US Federal Reserve, in his diary.

"It is a disgrace for a great nation like ours," agreed George McGovern, the Democrat candidate Nixon would punch below the belt in the 1972 election.

"By this act we will become the economic pariahs of the world."

But "Foreigners are out to screw us. It's our job to screw them first," said Nixon's Treasury Secretary, 'Big John' Connally.

You might know Connally better as the Governor of Texas, then sitting in front of John F. Kennedy when the younger, more TV-genic US President (who had defeated Nixon in the 1960 election) had been assassinated in Dealey Plaza, Dallas, 8 years before.

Still taken to wearing 10-gallon hats (white, of course) Connally was now Nixon's tough-talking sheriff at the Treasury.

And amid the caution and hand-wringing of Nixon's other advisors, Connally was here to run the bad guys out of town.

"So the other countries don't like it. So what?

"Let 'em [retaliate]. What can they do?"

For the other Western nations plus Japan, Big John had a point.

France was now running deficits of its own. That meant it didn't have another big pile of dollars to exchange for gold like it had done a half-decade before.

The UK had already devalued the Pound in 1967...spurring the chaos in gold trading which forced the collapse of central-bank cooperation in selling bullion to cap the price at $35 in March 1968.

West Germany had meantime just cut the Deutsche Mark free from its agreed currency peg, letting it float in May 1971 rather than soaking up ever-more dollars and risking an import of US inflation back home.

So like Connally said, what could they do?

Europe lacked leverage against the torrent of new dollar spending and deficits which the Nixon Shock would unleash. Especially as they had already failed to back the US in its Vietnam War.

But over in the Middle East?

Look! There's a dust-cloud on the desert horizon...

Neither Ben Cartwright in Bonanza on the Sunday night...

...nor Marshall Matt Dillon in Gunsmoke's Monday night repeat...

...could stop the most dishonest US President until the next one taking the Dollar, and therefore the world, off of gold.

"In recent weeks, the speculators have been waging an all-out war on the American Dollar," Nixon said in his 15-minute TV address, wonderfully titled 'The Challenge of Peace'.

"Accordingly, I have directed the Secretary of the Treasury to take the action necessary to defend the Dollar against the speculators...[and] suspend temporarily the convertibility of the American Dollar except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States."

Bang! Bang!

Both Bretton Woods and 5,000 years of monetary history slump to the dust, fatally wounded...

Gold was now frozen out of the system, much of it as good as irradiated and apparently useless inside US government vaults...

...just like bad-guy Auric Goldfinger had tried (and failed) in the 1964 movie of Ian Fleming's James Bond novel.

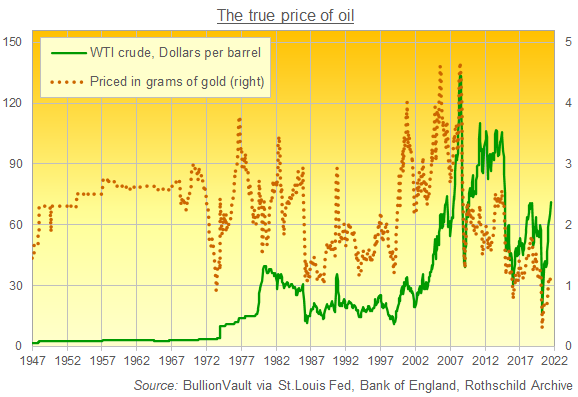

But while America's allies couldn't do much to shoot back, "gold-buying and oil-selling countries would respond in a predictable and rational fashion," says this excellent 2003 paper from US economic professors David Hammes and Douglas Wills.

"There was something very real that [Arabia] could, and did, do."

Hike the price of oil in Dollars to offset its plunge in gold bullion terms.

"Once the dollar-price of gold floated," say the professors, "and after the oil price shocks of 1973-74...the oil-price of gold tended to stay within its historical range of 10-15 barrels per ounce."

The two events...the Nixon Shock and the Oil Price Crisis...are still rarely linked in most people's minds, let alone in economic textbooks.

Domestic US politics are usually seen driving the first. The 1973 Arab-Israeli War is usually seen driving the second, punishing the United States for supporting Tel Aviv rather than Riyadh.

But as our chart above shows, the price of oil in Dollar terms...pretty much fixed before and immediately after the Nixon Shock...only soared once the gold value of oil had sunk thanks to the surge in world bullion prices following Tricky Dicky's Sunday Night Special.

Fast forward 50 years and so what?

Gold isn't money anywhere much, not as a means of exchange at least. The Dollar still rules. America's deficits have only worsened. And crude oil is apparently moving from a starring role to bit-part actor thanks to the boom in green energy tech.

That summary misses key changes however, not least the solid and growing use of gold in central-bank reserves, both as a source of financial strength and independence from US dominance and also as a blunt political symbol.

It also misses the key role which gold is coming to play in private banking and finance.

Nixon freed the Dollar from gold 5 decades ago next month, but he also cut gold free too.

It has shot up the town more than once since.

Good guy or bad, it's sure of a leading role in the next season.

Read more on the Nixon Shockwaves and the first 50 years of weightless money here...

Email us

Email us