Industrial Silver Hits 18-Month High Versus 'Safe Haven' Gold

SILVER PRICES extended this week's rebound on Thursday, re-testing last month's all-time high in Dollar terms and nearing the most valuable against gold bullion in almost 18 months as Thanksgiving 2025 saw Russia's President Putin called the US 'peace plan' for Ukraine a "serious" proposal.

Base metal copper − like industrially-useful silver, forecast to show a global deficit of supply versus demand in 2026 − edged back from new 4-week highs, while crude oil rose further from Tuesday's 5-week low.

"While silver hasn't massively outperformed gold, its stronger gains have come without the high media profile assigned to perhaps the more glamorous of the two precious metals," says an opinion piece at Reuters − one of the world's top 750 most visited websites, and No.29 for US traffic among all news outlets.

Silver today peaked within 10 cents per Troy ounce of $54, some 50 cents below mid-November's test of October's all-time spot market high, before fixing around $53.35 at London's midday auction.

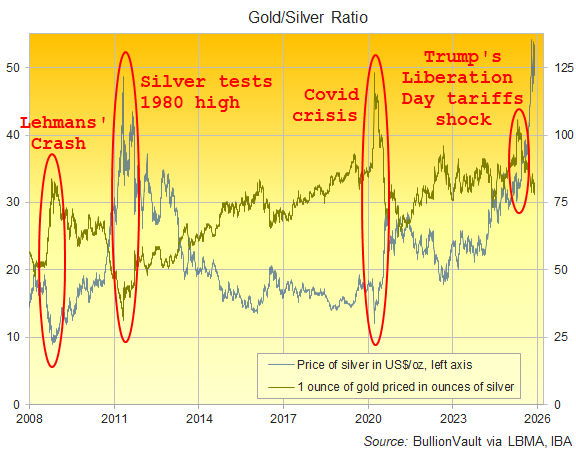

With gold bullion trading near $4150, that put the Gold/Silver Ratio − a simple measure of the 2 formerly monetary metals' relative prices − beneath 78, the lowest since July 2024.

Prior to this spring's spike in 'safe haven' gold's relative value against silver amid the stock market slump following US President Trump's 'Liberation Day' trade tariffs announcements, the ratio had never traded above 100 outside World War 2, the global economic recession of 1992 and 2020's Covid pandemic.

Lease rates to borrow silver bullion in London today rose to the highest in 2 weeks at 6.0% annualized for 1-month deals.

That compares to pre-2025's typical cost of near zero for borrowing what the Washington-based Silver Institute calls the "indispensble element".

Lease rates for fellow industrial precious metals platinum and palladium eased lower meantime, dropping to a still elevated 13.3% and 7.5% respectively, as trading began in China's new Guangzhou futures contracts.

"This initiative directly supports China's national strategic priorities," says the mining industry's World Platinum Investment Council, explaining that "GFEX's mandate is to develop financial instruments that serve the real economy.

"Given the government's strong focus on the energy transition and decarbonisation, platinum and palladium have been prioritised."

Back in silver, "The fourth quarter is typically peak season for solar installations," Bloomberg quotes analyst Zijie Wu at Jinrui Futures Co, pointing to photovoltaics as a major source of silver demand.

Silver stockpiles held in warehouses approved by Shanghai's SGE and SHFE trading exchanges have shrunk to decade lows, Bloomberg reports, after dealers made record-heavy exports to London, centre of the global market but itself hit by a silver squeeze thanks to heavy shipments to the USA for fear of the Trump White House imposing import tariffs on silver as a 'critical mineral'.

"Platinum started to tighten December into February," said a senior bullion-market executive speaking on the Metals in Motion panel at last month's annual LBMA industry conference, noting how Trump's election victory − and his repeated promise to introduce import tariffs − began pulling metal across the Atlantic.

"These are small markets compared to gold and silver, and primarily they're for industrial purposes, people need these things for military, aerospace, medical uses.

"[But] China is a closed market, and when you take away fungibility and portability, when you take away the Western notion of 'hey, we can move this stuff around', immediately you're going to get a lot of market dislocation and chaos."

Finally responding to the US peace plan for Ukraine today, "In general, we agree that this can be the basis for future agreements," Russia's President Putin told reporters during a press conference in neighboring Kyrgyzstan.

But pushing again to annex areas of Ukraine not yet under Russian control, and speaking as Brussels' securities depository Euroclear pushed back against EU plans to "confiscate" frozen Russian assets to help finance Kyiv's military, "Ukrainian forces will have to leave the territories they currently occupy, and then the fighting will stop," Putin went on.

"If they don't, we will achieve this by military means."

Email us

Email us