Platinum and Palladium Prices Leap on China's 'High-Conviction' Trading

GOLD FUTURES in New York joined silver bullion at fresh all-time highs Wednesday as the price of platinum and palladium leapt, hitting multi-year records following another strong trading day in China's new GFEX contracts.

Despite the real rate of interest averaging 18-year highs on US Treasury bonds across 2025, precious metals have now made the strongest annual gain since 1979 in gold and silver, the strongest since 2009 in palladium, and a series record back to 1990 in the price of platinum.

"If this were [just] an investment- or speculation-driven rally, we might have expected a stampede for the exits," says analysis from Japanese conglomerate Mitsubishi's precious metals team.

"But we don’t see that. This rally is supported by strong fundamentals and clearly driven by high-conviction players who are in it for the long run, with price perhaps only a secondary consideration."

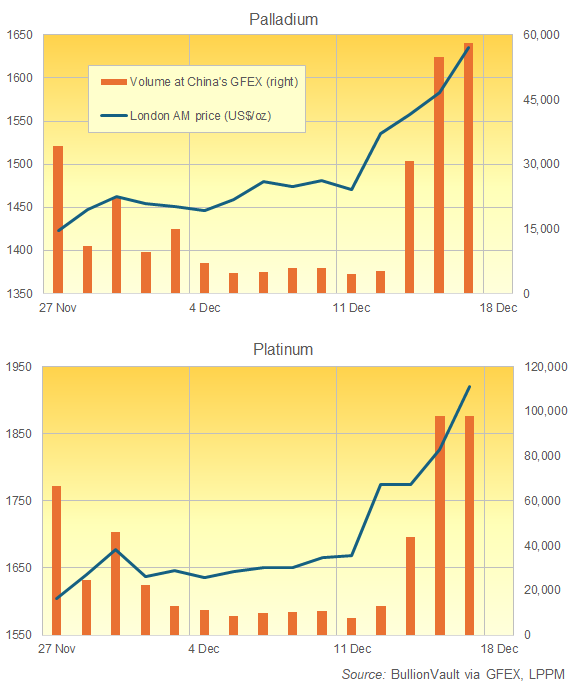

Trading volume in platinum futures on the Guangzhou Futures Exchange today matched Tuesday's new high, while palladium turnover set a new record for the 3-week old contracts.

Since the GFEX added its new contracts in late November, the price of platinum in London − currently the global bullion market's benchmark reference − has risen by 19.7% in US Dollar terms, while palladium has risen 14.9% over those 15 trading days.

"China’s approval of platinum and palladium [contracts] supports its strategy to secure vital green technology supply chains and reduce risk as countries pursue climate-friendly development," says Mitsubishi, "especially as it increasingly views PGMs as a critical mineral, much as the US has decreed.

"With inventories building at both US and Chinese exchanges, coupled with precautionary stock builds by some industrial companies, this suggests market liquidity will likely remain tight, keeping platinum lease rates elevated."

Jumping across 2025 on US President Trump's import-tariffs threat and stockpiling in China, lease rates to borrow silver and platinum remained far above typical levels on Wednesday, while palladium's 1-month lease rate eased 2 percentage points to just beneath 5% annualized − also very high historically.

Palladium prices today leapt to touch $1650 per Troy ounce for the first time since February 2023, twelve months after setting record highs above $3440 as No.1 mining nation Russia began its all-out invasion of Ukraine, provoking financial sanctions and import restrictions on Russian goods by Western authorities.

The platinum price meanwhile leapt Wednesday by almost $100 per ounce to reach $1935, its highest spot market print since the all-time highs above $2200 seen in early 2008, just before the crash phase of the global financial crisis hit with the collapse of Lehman Brothers.

Silver today set a new record high at $66.50 per Troy ounce and London gold bullion re-tested last week's benchmark auction peak of $4346 as New York Comex futures challenged mid-October's peak just shy of $4400.

Year-to-date, the price of gold in US Dollar terms has risen by 65.1%, silver by 123.9%, platinum 110.1%, and palladium by 79.9%.

Hedge funds and other speculative traders in US Nymex platinum futures and options have now been bullish without pause since mid-May as a group.

But the latest commitment of traders data from US regulator the CFTC said they remained bearish on palladium, taking a net short position without break since October 2022.

Email us

Email us