Gold and Silver Set Fresh Records Ex-Dollar After Trump's Shock UN Speech

GOLD PRICES fell against a rebounding US Dollar on Wednesday but the 'safe haven' set fresh all-time highs in most other major currencies as Western bond and stock markets slipped following US President Trump's shock speech to the United Nations.

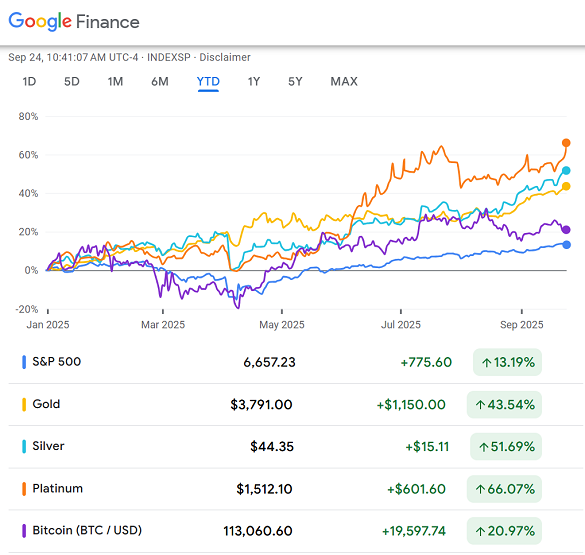

2025's price surge for platinum and silver also edged back in US Dollar terms after touching new 14-year and 11-year highs respectively ahead of Trump's speech on Tuesday.

But the more industrially-useful precious metals retained their position as the best-performing investments of 2025 to date in any currency.

Gold bullion in London, heart of the precious metal's trading and storage network, today traded down to $3751 per Troy ounce, some $40 off Tuesday's new all-time gold high near $3800 for US Dollar investors.

But gold continued to rise ex-Dollar, hitting a new record in Euros at €3214 and in UK Pounds at £2807 per ounce, while setting a new Japanese Yen high above ¥18,000 per gram after closing trade in Shanghai with a fresh Chinese Yuan record of ¥855 per gram earlier today.

Variously called "deranged", "staggering" and "incoherent" by newspapers in Europe and "an embarrassment" and a "rant" with "no shortage of false claims" by mainstream US media, Trump's speech to the UN General Assembly yesterday "was downright dismissive of the organization," says Time magazine, "belligerent toward a room filled almost entirely with longstanding US allies."

"The entire globalist concept of asking successful, industrialized nations to inflict pain on themselves and radically disrupt their entire societies must be rejected completely and totally," Trump told the UN, dismissing "open borders" and what he called "the climate hoax".

"I have come here today to offer the hand of American leadership and friendship to any nation in this Assembly that is willing to join us in forging a safer, more prosperous world," he went on, before further surprising delegates by saying he now believes Ukraine can win back all the territory seized by Russia since its invasion began in 2022.

"We have no alternative" but to continue the war, replied a Kremlin spokesman today on RBC Radio in Russia, where the MOEX stock index fell to its lowest since end-July in Ruble terms.

With economic growth slowing hard, Moscow will next year raise VAT sales tax from 20% to 22% to help cover the ongoing cost of Russia's war.

With the Dollar rebounding to 3-week highs on its DXY index, the price of gold for US investors today failed to set a new all-time record for only the 8th session in 18 so far this month.

Silver meantime fell 3 times back through $44 per Troy ounce before recovering that level again, but it hit a new Euro lifetime high of €37.75 plus new GBP and JPY records at £32.97 per ounce and ¥211 per gram respectively.

The CSI stock index in world No.1 gold consumer China meantime finished Wednesday at a new 3.5-year high, but the Sensex in No.2 gold consumer India hit 2-week lows − and the Rupee fell to a new all-time low on the FX market − after Trump threatened both Asian giants with further economic sanctions in his UN speech for continuing to buy oil and gas from Russia despite its invasion of Ukraine.

Email us

Email us