Gold Tries $3800 as China Challenges Western Bullion Trading

GOLD BULLION leapt again Tuesday, trading up to its 10th new Dollar record so far this month as analysts hiked their 2025 and 2026 price forecasts, investors digested the first ever speech by a member of the US Federal Reserve who also works for the White House, and a news report claimed that China is inviting foreign governments to store central-bank gold reserves in Shanghai.

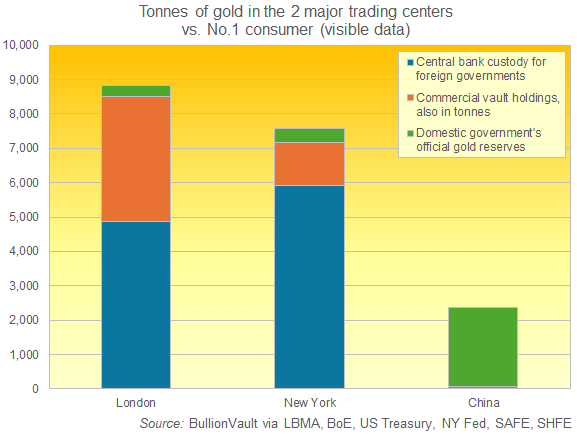

China's Communist government has so far met interest from at least one south-east Asian country, says Bloomberg, presenting the move by gold's No.1 miner, importer, central-bank buyer and consumer nation as a challenge to the global dominance of New York and London gold custody and trading.

"Including the shocks I've considered," said Donald Trump's economic advisor Stephen Miran yesterday, laying out his view of the r-star 'neutral interest rate' and listing "shifts in border and tax policy, trade renegotiation, and regulatory dynamics" in his first speech since joining the US central bank, "I get a new real r* that is 1 to 1.2 percentage points lower" than current Fed interest rates, down "near zero".

Despite international concern over Trump's fiscal, foreign and trade policies, New York has seen privately-owned bullion holdings surge to record highs in 2025 amid fears that the White House would put import tariffs gold.

The quantity of gold bullion held at the New York Fed for foreign governments and central banks has meanwhile risen 0.3% according to Federal Reserve data.

London's Bank of England custody holdings in contrast shrank 3.3% over the year-to-September, in part to feed those bullion inflows to New York. But London's commercial vaults more than offset that outflow, taking the city's wholesale bullion bar holdings 1.6% higher to the most in 2 years.

Bloomberg's report comes four months after the People's Bank of China − which now owns some 2,300 tonnes in bullion reserves on the latest official data − called on the Shanghai Gold Exchange to "expand [and] explore the internationalization" of its contracts as part of a new "Action Plan for facilitating cross-border financial services in Shanghai."

While no data is available for SGE-approved gold warehouse holdings, the Shanghai Futures Exchange today reported a customer stockpile of 59 tonnes − almost 4 times the quantity held at the SHFE at the end of last year, but a fraction of the 1,234 tonnes held by CME-approved warehouses in the USA today, and nothing next to London's commercial vault holdings of 3,645 tonnes at the end August.

Gold bullion in London, the physical metal's central storage and trading hub, today jumped to peak at $3791 per Troy ounce in spot-market dealing, rising by more than $100 this week so far.

Shanghai's gold price also hit a new record, but it continued trading at a Dollar-equivalent discount to London bullion, fixing $37 per ounce below global gold quotes at today's SGE benchmarking auction.

Silver also jumped again Tuesday, setting fresh all-time highs in Japanese Yen, Chinese Yuan, UK Pounds and Indian Rupees, while topping $44 per Troy ounce for Dollar traders in London.

That level has only been beaten on 8 trading days ever before, 3 times at January 1980's $50 peak, and 5 times around April 2011's re-touch of that all-time record high.

Back in gold, Swiss bank and London bullion clearer UBS on Friday raised its year-end price forecast to $3800 per ounce, less than $10 above Tuesday's new peak.

UBS came into 2025 predicting a peak of $3100 and an annual average of $2800, some 12.0% beneath this year's average daily price so far.

US financial giant J.P.Morgan most recently raised its gold price forecast to an average of $3675 across the final 3 months of 2025 after starting the year predicting a peak at $3000.

German financial giant Deutsche Bank predicted that gold would reach $2800 by end-2025, but now projects an annual average of $4000 for 2026.

That would equate to a 25.7% rise from this year's average-to-date, itself rising 33.3% from 2024 after making a 23.0% annual average rise last year.

Gold priced in Euros today hit fresh all-time highs above €3200 per Troy ounce, while the UK gold price in Pounds per ounce peaked above £2800, also 2.5% higher for the week so far.

Email us

Email us