Gold and Silver Forecasts 'Beyond Outlandish' After 2025's Bad Miss

GOLD and SILVER PRICES jumped to fresh all-time highs on Tuesday, marking the 1st anniversary of Donald Trump's return to the White House by extending 2026's run of new records as precious metals analysts followed last year's bad miss by making the most bullish forecasts so far this century.

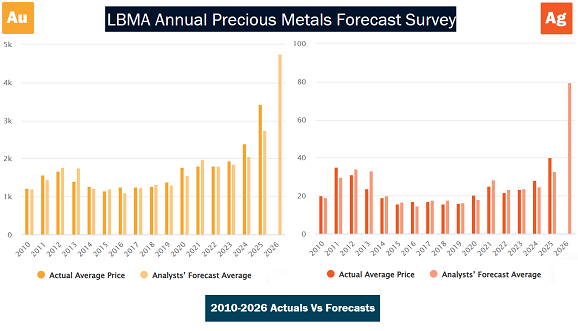

The 2026 Forecast Survey, gathered and published by precious metals trade body the London Bullion Market Association, says that on average professional analysts and traders now see this year's average daily gold price rising by almost 2/5ths from 2025, while the annual average price of silver is projected to double.

Both of those silver and gold price forecasts are by far the most bullish average forecasts on the LBMA's Survey back to the early 2000s.

Today's avowedly "outlandish" forecasts from former banking and refining executive Ross Norman − one of the longest-running and most successful precious metals forecasters in the LBMA competition − are topped by 3 other analysts in gold, 1 in silver, 4 in platinum and 2 in palladium.

Today's consensus gold forecast − now projecting a rise of $1310 across 2026 to $4742 − comes after analysts on average missed 2025's gold price rise of $1045 per ounce by almost $700, a record bad miss in Dollar and percentage terms.

Last year's LBMA Survey consensus also missed silver's annual average outcome of $40 per Troy ounce by a record, coming $8 below.

Now the 2026 predictions, on average, foresee a rise of 98.8% to more than $79.50.

With silver fixing in London at midday today around $95.60 per Troy ounce, nine of the 26 silver forecasts in this year's LBMA competition have already seen the industrially-useful precious metal breach their high-point prediction.

Global stock markets in contrast fell Tuesday with bond and commodity prices as a survey from the annual World Economic Forum in Davos, Switzerland said that politicians, financiers and business leaders see 'Geo-economic confrontation' as the risk "most likely to present a material crisis on a global scale in 2026", followed by 'State-based armed conflict'.

President Trump will tomorrow meet with leaders of the USA's European Nato allies to demand that Denmark give Greenland to America.

"Nobody wants him because he's going to be out of office very soon," said Trump last night of Emmanuel Macron when asked about the French President's apparent refusal to pay $1 billion to join the US-led 'Board of Peace' controlling war-torn Gaza.

"That's all right. I'll put a 200% tariff on his wines and champagnes, and he'll join. But he doesn’t have to."

"Europe is at a total loss and, to be honest, it's a pleasure to watch this," says Russian tabloid Moskovsky Komsomolets of the US-Europe argument over Greenland.

"If Trump annexes Greenland by July 4 2026, when America celebrates the 250th anniversary of the Declaration of Independence, he will go down in history as a figure who asserted the greatness of the United States," says Kremlin mouthpiece Rossiyskaya Gazeta.

Touching $4747 per Troy ounce today with its 7th new daily high in 13 sessions so far this year, gold bullion in global trading hub London has risen more than 75% since Trump was sworn in as the 47th President of the United States 12 months ago today.

That's the sharpest ever 12-month move for gold prices under any US President other than the start of Richard Nixon's second term in 1973, which ended with his resignation the following August over the Watergate scandal.

Across all forecasts in today's LBMA 2026 Forecast Survey, gold's trading range is seen running from a low of $3450 to $7150.

Silver's forecast range is wider still, with the lowest low-end forecast from today's LBMA entrants coming at $42 and the highest high at $165.

Email us

Email us