Oh No! Gold Driven by Speculators? Really?

So close, so clueless from The Economist...

The BEST THING about a big bull market in gold? writes Adrian Ash at BullionVault in this note first sent to Weekly Update readers in late November.

It makes instant experts of anyone and everyone who takes a glance at the price.

The Economist for instance.

"Speculators [are] the most likely drivers of recent price movements," says the world's best-selling weekly magazine...

...gasping like it's discovered a new Moon.

"What may have started, months ago, as a limited push for more gold in central banks' reserves seems to have snowballed into a self-propelled mass of hot money chasing prices higher.

"At some point, this classic 'momentum trade' of investors following trends will stop."

Oh no! Better sell it all now, before "some point" stops being "like, whenever".

And the evidence?

"The gold price," The Economist says of late-2025's action, "closely tracks [hedge funds and gold-backed ETFs'] flighty appetite."

No! You're kidding. Really?

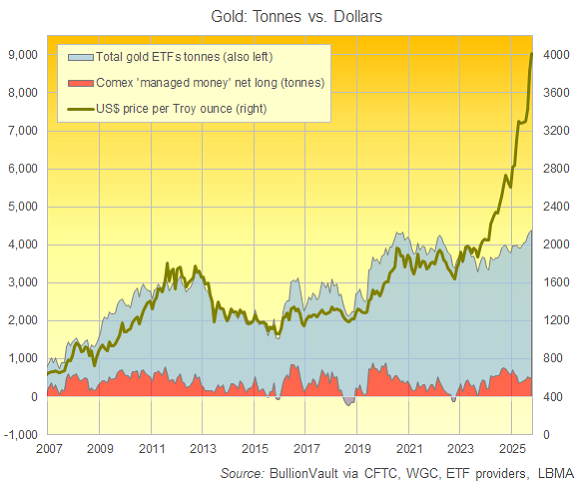

Gold-backed ETFs became a thing around 20 years ago, roundabout the same time that US regulators the CFTC began releasing data for what 'Managed Money' speculators are doing in Comex futures and options bets.

Added together, these 2 data sets don't offer a perfect proxy for total global investment flows into gold. But they're the best shorthand we've got...

...and it's a fact that, since these numbers became available in 2006, gold prices have pretty much always tracked the size of those gold ETF and Comex hot-money positions combined. (Or maybe the other way around.)

This makes sense, just like it makes for Wall Street (and its wannabees) to throw money at hiring the hottest traders in the hottest markets.

Big trading-desk profits mean big trading-desk pay-days. Rising gold prices mean rising ETF demand and a rush of leveraged bullish betting.

So what's truly notable − and what The Economist misses in its latest rush to write off gold yet again, even though it's the best-performing major asset of both 2025 and the 21st Century to date − is how that relationship between gold prices and positioning broke down around 3 years ago.

Up until New Year 2023, the size of gold positioning...

...meaning the weight of all gold-backed ETFs worldwide, plus the notional tonnage of Managed Money net betting...

...had since 2007 moved in the same direction as gold prices, higher or lower, 88% of the time both month-to-month and also year-over-year.

Across the first 6 months of 2023, however, that dropped to 66% of the time month-to-month, and it sank on a 12-month basis to just 17% of the time across the year-and-a-half to summer 2024.

That was a notable break. And it's over. Because since then, the relationship has snapped back...

...with gold positioning and prices moving together 88% of the time month-to-month...

...and giving a perfect 100% reading year-over-year.

So yes, The Economist is right that "speculators" have participated in the latest surge in gold prices, if not driven it.

But that's simply a return to the norm. And it also answers the question which we asked again and again last year...

...about what might happen to gold prices when investors and speculators finally returned to gold after sitting it out between $1800 and $2600.

We first spotted the return of normal service in September 2024, in fact. It has since taken hold right across our marketplace, with ETF holdings jumping as Comex speculators pile in and private investors in the big Western economies also return to buying gold bullion.

To be sure, this "momentum" then rushed towards a blow-off top in October. All those headlines about people lining up to buy gold outside retailers in Japan, Australia and at online stores worldwide gave magazine pundits all they needed to shout "Bubble!"

Yet they didn't. Even The Economist uses the word "bubble" only twice in its latest put-down...

...first when it speaks of the (actual) bubble in AI stocks and investment...

...and then when it claims (probably rightly) that central banks have "no urge to bet the farm on gold, especially if doing so would mean chasing a bubble."

If, if, if? Maybe the magazine's hesitance should worry us. Because, as the old lags on Wall Street like to say, bull markets end when the last bear throws in the towel and buys.

But The Economist hasn't turned bullish. Not yet. And maybe, just maybe, gold in the wider world has cemented its return as a portfolio asset...

...finally breaking its long-term pattern of boom and bust...

...thanks in part, as the world's best-selling weekly magazine notes, to central bank gold buying, but maybe more because it was and remains the best-performing asset bar none across the 21st century to date.

As it is, investors are playing it cautious after October's huge price spike.

ETF holdings have expanded so far this month by the least since May, while 'hot money' hedge funds are likely to be trimming their bets. (They almost always do going into the USA's long Thanksgiving weekend.)

Indeed, the Managed Money of Comex traders began trimming their bullish futures and options ahead of the top, cutting by 10% in the first week of October...

...currently the latest available data from US regulators the CFTC, delayed (like so much other official data) by the shadow of last month's US government shutdown.

More updates on that as we get them. But for now, the relationship between "speculation" and gold prices doesn't warrant a headline. Not beyond noting that it has returned after a much more remarkable absence.

Email us

Email us