Gold's Panic-Free Rush Sees First-Time Bullion Buyers Triple

Record prices, post-Covid record new users at gold No.1...

GOLD INVESTING has jumped as bullion prices run to fresh all-time near $4,000 per ounce, with BullionVault seeing the largest number of new users since the Covid Crisis peaked five years ago, writes Adrian Ash at the world-leading precious metals marketplace.

Now caring for a record $7.2 billion of precious metals (£5.3bn, €6.1bn) for 120,000 users worldwide, BullionVault in September saw the most new account openings since August 2020, with the number of first-time investors jumping 87.6% from the previous month and more than tripling from September last year, rising 213.5%.

In 20 years of operation, in fact, BullionVault has never been busier except in the all-out crises of 2008, 2011 and 2020.

Lehman's crash, Europe's debt crisis and the Covid lockdowns were clear and immediate emergencies, spurring huge demand for gold. This year's gold rush, in contrast, comes without any panic in the wider financial markets.

Instead, the 'safe haven' has jumped to new record prices − making gold's steepest ever 1-month gain with a rise of $400 in September − as global equities and Bitcoin also hit new all-time highs. Added together, this move to quit cash and hedge against inflation signals long-term anxiety over currency debasement and the size of government debts.

Which is why most investors in gold buy the stuff. But a good number of previous buyers are trimming their holdings too at these new record prices.

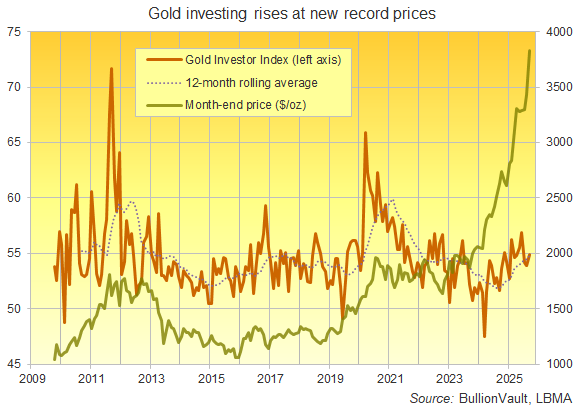

BullionVault in September saw the Gold Investor Index − a unique measure of private sentiment derived solely from actual trading behaviour − rise by 1.0 point from August's 7-month low to read 54.9, the strongest level since June's 4-year high.

Tracking the number of buyers versus sellers across the month, the Gold Investor Index would read 50.0 if they balanced each other exactly. It set a decade peak of 65.9 in March 2020 as the pandemic lockdowns began, and it set a series low of 47.5 four years later on a surge of profit-taking.

This September's rise took the Index's 12-month average up to 54.7, the strongest underlying level since New Year 2022 and matching exactly the Gold Investor Index's full series average.

Against that more measured move in sentiment, why the surge in new buyers and the jump in gold prices?

Well, when you have establishment names like Morgan Stanley telling investors that they don't own enough gold, it's no surprise to see inflows jump, whether into ETFs or vaulted bullion.

Hell, even the gold coin and retail bar market is finally finding new demand, albeit with continued heavy profit-taking by existing owners.

Overall on BullionVault − where investors buy and sell gold held in large, securely stored wholesale-market bars, slashing costs with 24/7 access − client demand was offset by client sales for the third month in a row in September.

That kept the total quantity of gold belonging to BullionVault users just below 44 tonnes, now worth a record $5.4bn (£4.0bn, €4.6bn, ¥800bn).

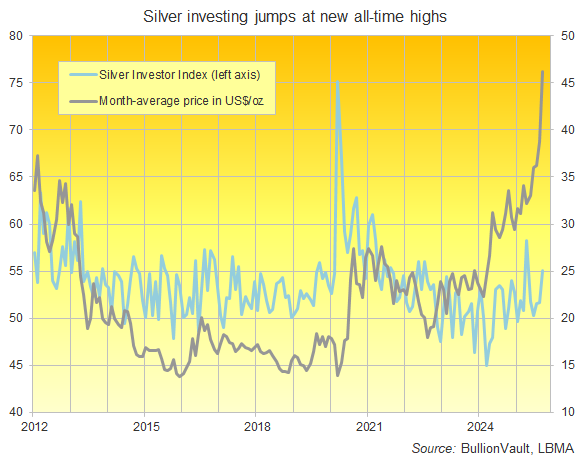

BullionVault users were also close to flat overall in silver last month, trimming their total holdings 0.2% by weight to 1,155 tonnes worth a new record $1.7bn (£1.2bn, €1.4bn).

That came as the more industrially-useful precious metal leapt to new month-average record highs in all currencies, finally topping the silver price Dollar peak of April 2011 with a rise of 12.1% (+11.6% in GBP, +11.1% in EUR).

The Silver Investor Index rose by 3.4 points to 55.1, its highest since April's 4-year high and overtaking the Gold Investor Index for only the 6th time in the past 3 years.

After jumping on Trump's US trade tariffs shock this spring, gold and silver prices are now surging again as the White House attacks Fed independence over interest rates.

But bullion is far from only a Dollar story right now, rising sharply and setting new highs for investors everywhere. Trump's return to the Oval Office has clearly triggered this year's surge in precious metals prices, his policies only highlight the need for investors and savers to hedge against inflation, but he didn't create it.

Email us

Email us