Gold and Silver Slip as US Seizes 'Russian' Oil Tanker, Defense Stocks Rise Again

GOLD and SILVER PRICES slipped Wednesday from this week's rebound to their Christmas Week records as the US military followed last weekend's arrest of Venezuelan President Maduro by seizing a Russia-flagged oil tanker in the North Atlantic.

Watched by a Russian warship and submarine, US troops boarded the Marinera − called the Bella 1 until its crew yesterday painted a Russian flag on its hull, a move recognized within hours by Russia's shipping registry − after pursuing the apparently empty oil tanker from Venezuela into the ocean between the UK and Iceland.

Despite agreeing a post-ceasefire plan for Ukraine with European partners on Tuesday, the White House said overnight that President Trump may use military force to capture Greenland from Nato ally Denmark.

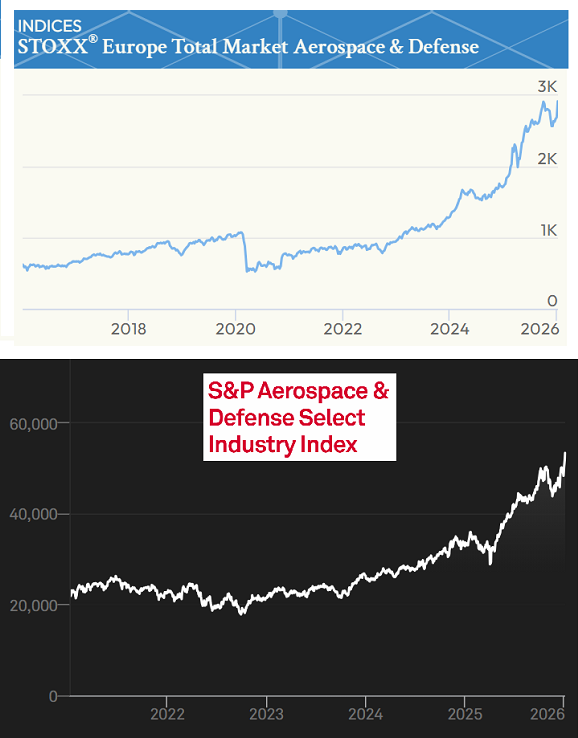

Like gold and silver prices, rich-economy stock markets slipped from yesterday's new all-time high on the MSCI World Index. But defense sector shares in Europe bucked the trend and rose for the 4th session running to trade over 71.5% higher in Euro terms from early January 2025, eve of Donald Trump's return to the White House, followed by a 2.4% rise in US defense sector shares at today's New York open.

Gold bullion prices on Tuesday set a fresh 3pm London benchmark record at $4490 per Troy ounce, some 1.3% below last Monday's post-Christmas spot market record of $4549, before falling back to $4440 today.

Silver meantime set its 3rd new London midday high in a row on Wednesday, fixing around 30 cents above yesterday's auction high of $78.48 after peaking in spot market dealing at $83.90 amid last week's Chinese Christmas chaos in precious metals trading.

Today's tanker seizure "will be considered an attack on Russia, a crisis situation," said Kremlin advisor Andrei Fedorov to the BBC, adding that yesterday's European agreement with Kyiv's President Zelensky to station troops in Ukraine following a ceasefire with Moscow is "a red line" for President Putin, meaning he won't accept any peace deal on those terms.

As for Greenland, "If the USA takes full control, it's a serious threat, creating problems for Russian missile systems targeted at the United States" across the Arctic.

Oil prices today slipped in Europe and America, taking benchmark Brent back towards $60 per barrel while Russia's Urals Blend fell to new 30-month lows beneath $50.

Having declared on Monday that "This is OUR Hemisphere, and [I] will not allow our security to be threatened," President Trump said yesterday that Venezuela "will be turning over" some 50 million barrels of "high quality" oil to the US Government, while the US oil industry will be "up and running" in Venezuela within 18 months.

Gold in China today flipped back below London quotes, trading at a discount of almost $20 per ounce against yesterday's premium of $11 per ounce as Shanghai prices slipped in Yuan terms.

Shanghai silver also eased lower, cutting its premium to London from $8 to $6.85 per ounce before accounting for China's import VAT tax.

Silver borrowing costs in London eased to 5.09% annualized for a 1-month lease, dropping further from Monday's 10-week high near 8.9%.

The Dollar slipped against other Western currencies, snapping a 2-week rally from Christmas Eve's near 3-month low on its DXY index.

US defense stocks also rose Wednesday, with the S&P Aerospace & Defense Select Industry Index up 2.3% to gain more than 1/10th so far in 2026.

Email us

Email us