Last Time Gold Did This? 2011

- Ten years ago this March, the near-collapse and bail-out of Bear Stearns saw gold break above $1000 for the first time ever. The crash phase of the financial crisis was on.

- Five years later the gold price sank at its fastest quarterly pace in 3 decades, plunging as investment funds sold on chatter about 'QE tapering'. Spurred by the end of ever-growing monetary stimulus from the Federal Reserve, that Q2 2013 gold crash agreed with the Fed that the global financial crisis was over.

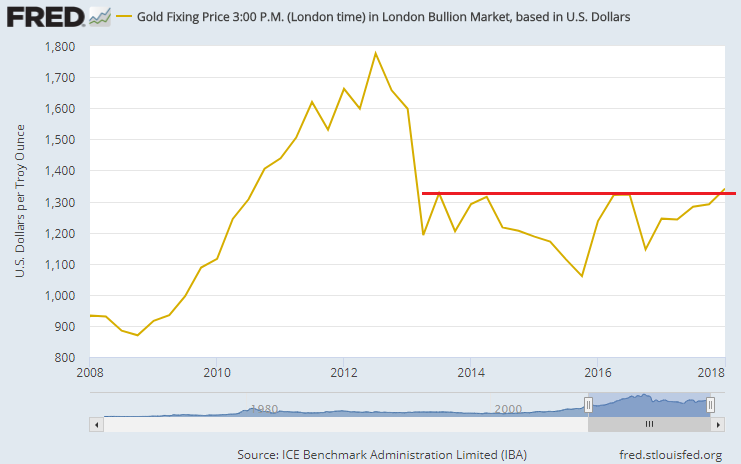

- But now we're 5 years beyond that. And gold is trading at the top of the last half-decade's post-post-GFC price range.

- We're now 5 years on from the Fed announcing the end of the global financial crisis with its 2013 taper talk. Gold is showing its highest quarterly close since then;

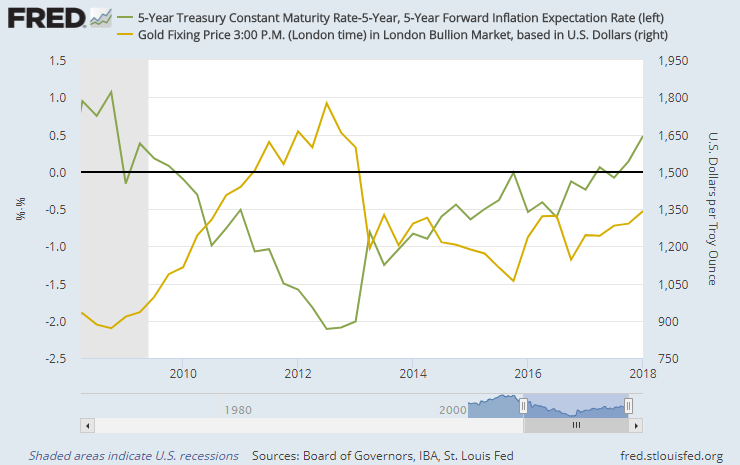

- To get here, gold has shrugged off the rise in real interest rates. They acted as kryptonite during the first half of the post-GFC period. For now at least, that spell has been broken;

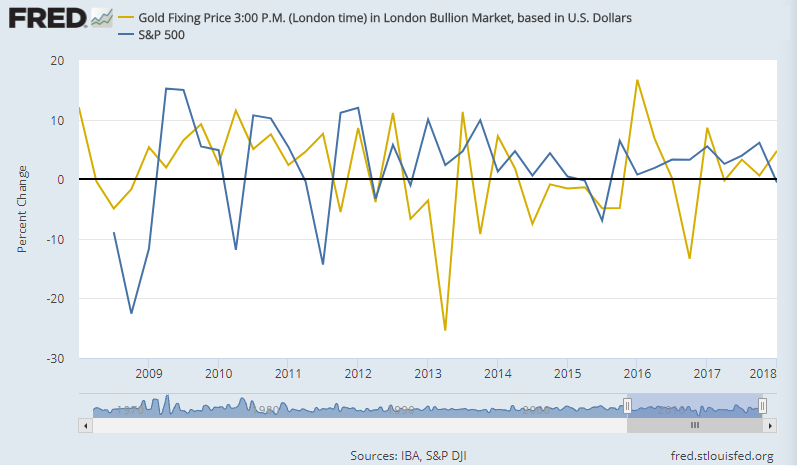

- On a quarterly basis, gold also stands on the verge of doing exactly what investors want it to do: Go up when the stock market falls.

Email us

Email us