Silver Tops $61 in 'Shortage' vs. Price Feedback Loop

SILVER PRICES leapt to fresh record highs in London on Wednesday, peaking above $61 per Troy ounce as the 'shortage story' combined with traders betting that the Federal Reserve will cut interest rates today, but then make no change until mid-2026.

Next June will mark the first Fed meeting with a new chair after May's departure of Jerome Powell, repeatedly attacked by US President Donald Trump for leaving interest rates "too high".

"Vol, incoming," says one London bullion bank's trading desk, forecasting volatility across all markets as traders then digest today's US Fed 'dot plot' forecasts for growth, inflation and interest rates.

With gold stuck below $4200 per Troy ounce today, more than 3.0% below mid-October's record price, silver set its 5th new all-time high in 8 sessions so far this December.

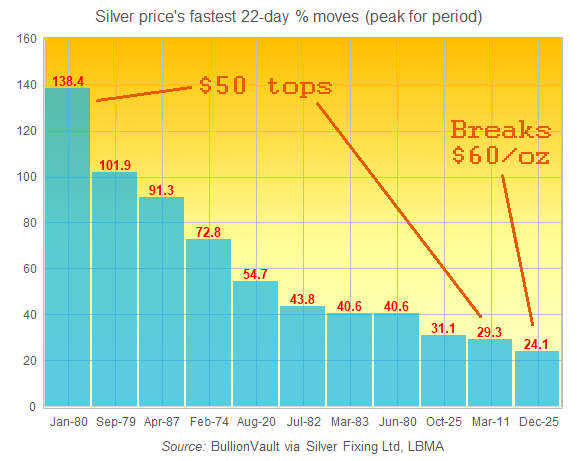

But its 1-month pace of price gains slowed to 22.0% from Tuesday's 24.1%, a rate of increase beaten by mid-October's 31.1% surge, which was the fastest since August 2020's Covid rebound leap of 54.7%.

That still put today's 22-day pace of silver price rises in the top 2.5% of all 1-month moves since 1968.

A fall in the rate of interest paid on cash in the bank "naturally shifts demand toward assets viewed as stores of value, including silver," the BBC quotes Nanyang Technological University's Yeow Hwee Chua, Assistant Professor in Economics.

"In the very near term, the focus is on the Fed rate meeting," agrees bullion-market analyst Suki Cooper at Asian-focused London-listed bank Standard Chartered, quoted by the Financial Times.

"[But] underlying the move is the fact that we have a silver market that has been undersupplied for the past five years, and we still have regional stocks dislocation."

With silver breaking above $60 per ounce, "[this] narrative of physical tightness in the silver market...is luring more short-term speculators and trend followers into the market," CNBC quotes Swiss private bank Julius Baer's analyst Carsten Menke.

"A large influx of funds into silver-backed exchange-traded products has further strengthened the upward trend in prices," says China's state-owned Xinhua news agency.

"Analysts believe that silver prices will continue their steady upward trend. But in the short term, they are likely to fluctuate at high levels, and the risk of a pullback should not be ignored."

Shanghai silver prices leapt almost 3% at the start of Wednesday's trading, setting a new all-time high in Chinese Yuan.

Silver stockpiles at warehouses approved by the Shanghai Futures Exchange meantime grew by 24 tonnes to almost 742 tonnes, rebounding by more than 1/4 from this time last month.

New York stockpiles held in CME-approved warehouses have held almost unchanged so far this week, close to the smallest since what was a new record high in March at 14,177 tonnes.

London stockpiles grew another 3.5% in November to 27,186 tonnes, the largest in 26 months − and more than 1/5th larger than March's series record low − on data gathered and published by trade association the LBMA.

Today's jump in the silver price pushed down the Gold/Silver Ratio to 68.5 when comparing the 'safe haven' metal's 10:30am fixing against its more industrially useful cousin's 12 noon auction, a new 4.5-year low.

Yesterday's "strong data points" from the USA — led by "surprise" strength in JOLTS jobs openings, plus White House approval for AI chip giant Nvidia to ship new product to China, a move apparently rebuked by Beijing — "bolstered a pro-growth narrative that helped spark gains in silver, platinum, and palladium," says a trading note from Chinese-owned London bullion bank ICBC.

For silver, "Sectors such as solar energy (PV), automotive electric vehicles (EVs) and their infrastructure, and data centers and artificial intelligence (AI) will drive industrial demand higher through 2030," says the Washington-based Silver Institute of miners and users.

Silver will again see a deficit of supply to meet total demand in 2026, specialist analysts Metals Focus predict, albeit the smallest gap since 2021.

Email us

Email us