Gold Hits 4.5-Year Low Vs. $60 Silver on US Jobs Jolt

SILVER BULLION topped $60 per ounce for the first time in history late in London on Tuesday, driving down the relative price of 'safe haven' gold to its lowest value in terms of the industrially useful precious metal since July 2021.

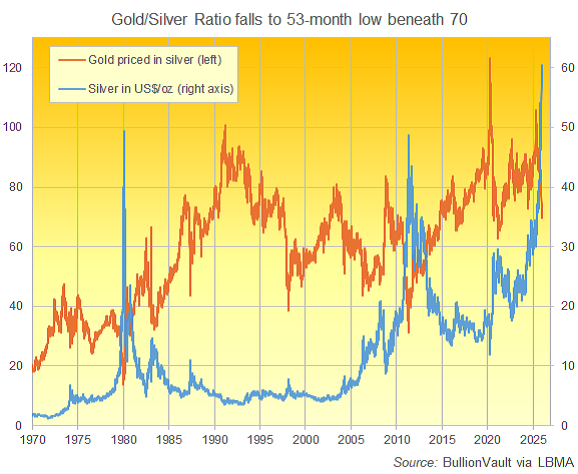

With gold trading at $4217 per Troy ounce this afternoon as silver spiked towards $60.47, the Gold/Silver Ratio dipped beneath 70 for the first time in 53 months.

Widely seen as a barometer of investment fear versus economic growth, the ratio of gold to silver prices per ounce averaged 67.6 in the 2010s, rising to 82.5 between 2020 and 2024 and then rising again to 89.2 so far across 2025.

"Ultimately," says the latest note from analysts SFA (Oxford) for German precious metals refiners Heraeus, "silver is a higher beta, ie more volatile, investment than gold.

"The drivers of the gold price − namely, economic and geopolitical concerns, US fiscal and monetary policy, central banks cutting interest rates, and their impact on the US Dollar − will also influence the silver price."

Today's jump in the silver price, up 2.5% in US Dollar terms inside 70 minutes, came after delayed 'Jolts' data following this fall's record-long US government shutdown said job openings in the world's largest economy rose in both September and October

Tomorrow's meeting of the US Federal Reserve still carries a 9-in-10 chance of bringing a cut to interest rates, according to positioning in the Fed Funds futures market tracked by derivatives exchange the CME.

US financial giant Citi now forecasts silver prices hitting $62 per ounce by March "on the back of Fed cuts, robust investment demand, and a physical deficit" between global mining supply and overall demand.

Buoyed by growing electricals and electronics use in AI data centers, silver's industrial demand is likely to touch a new all-time high across 2025, according to specialist analysts Metals Focus.

But its total demand from the photovoltaic solar energy sector will probably show a small drop as the industry works to reduce silver loadings still further from the 90% drop seen since the precious metal peaked at $50 per ounce silver in 2011.

Email us

Email us