Silver Hits New Record Prices as Trump 'Picks Hassett' to Run the Fed

GOLD and SILVER prices extended Friday's surge further on Monday, hitting 6-week and new all-time highs respectively as the US Dollar lost value after Donald Trump said he has made his choice for the next chairman of central bank the Federal Reserve, writes Atsuko Whitehouse at BullionVault.

"I know who I am going to pick, yeah," the President told reporters on Air Force One yesterday as he flew back to Washington from Thanksgiving in Florida, but without naming his choice.

Named last week in a Bloomberg story, Trump's National Economic Council Director Kevin Hassett is widely expected to succeed current Fed chair Jerome 'Too Late' Powell next spring.

"I think that the American people could expect President Trump to pick somebody who's going to help them have cheaper car loans and easier access to mortgages at lower rates," Hassett said in a TV interview on Sunday.

"That's what we saw in the market response to the rumour about me...We had a great Treasury [bond] auction, interest rates went down."

With the Dollar's trade-weighted DXY currency index sinking near 5-week lows on the FX market Monday, betting that the Fed will decide to cut interest rates at this month's meeting – seen as worse than an evens chance on 'hawkish' Fed comments 2 weeks ago – leapt to an 87% certainty according to the FedWatch tool from derivatives exchange the CME.

Spot gold rose as much as 1.2% to $4262 per Troy ounce, some 2.7% below its mid-October all-time Dollar price peak and extending Friday's 1.2% gain when the Comex futures and options market shut down for 10 hours due to technical issues.

Today's move pushed gold's year-to-date gain up to 60.6%.

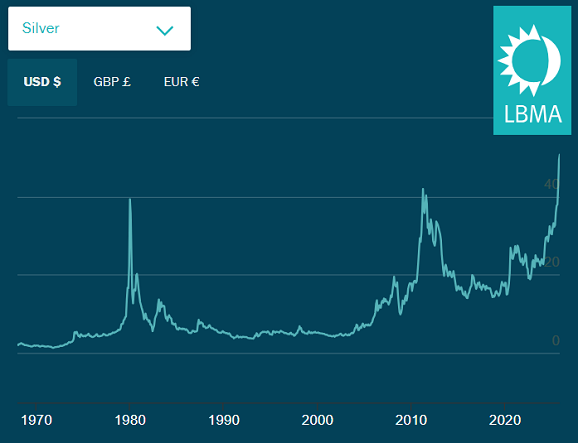

Prices for silver – which finds more than half its net demand from industrial uses such as solar panels – surged as much as 2.5% to hit a fresh Dollar high for the second session running at $57.85.

This followed a 5.5% jump in the previous session, also taking its 2025 rise to the strongest in 46 years at 86.5%.

Interest-rate trading now says Fed rates will finish 2026 at 2.99%, according to market consensus – almost half a point below the US central bank's latest 'dot plot' projections for next year.

Platinum – used in auto-catalysts to cut harmful emissions from fossil-fuel engine systems, including hybrid-electric vehicles – also jumped Monday, adding as much as 3.7% to $1727 per ounce, a 6-week high.

Gaining 79.6% year-to-date gain, platinum is on track for its biggest annual increase since current daily benchmark prices started in 1990.

Sister metal palladium – which finds four-fifths of its end-use in fossil fuel engines – rose as much as 4.1% to $1513 per ounce, marking a 59.3% increase so far this year.

"Silver and platinum are extending their strong run amid persistent supply tightness and firm investor demand for hard assets," says derivatives platform Saxo Bank's commodity strategy team, adding that the move is being driven by a combination of Fed rate-cut expectations, currency-debasement concerns, fiscal-debt anxiety, and sticky inflation in the cost of living.

Despite the Dollar falling on the prospect of Hassett joining and leading fellow White House economic advisor Stephen Miran at the Fed in 2026, gold also rose in all other currencies as silver prices hit new record highs.

The strength of silver pushed the Gold/Silver Ratio – which tracks the two formerly monetary metals' relative prices – down further to just above 74, the lowest value for gold versus silver in 18 months.

Gold meantime hit a new all-time of its own in Japanese Yen, rising to ¥21,291 per gram even as the currency strengthened on the FX market after Bank of Japan Governor Kazuo Ueda said the central bank will consider the "pros and cons" of raising rates at its next policy meeting – remarks viewed as the most hawkish in recent days.

Email us

Email us