Gold and Silver Sink from New Records Amid US Jobs Data Gap

GOLD and SILVER sank after hitting fresh all-time and 14-year highs respectively on Thursday as global stock markets rose to new records and the black-out of official US data caused by the government shutdown left traders and investors tracking private-sector job market estimates instead.

After reversing an overnight 1.1% drop for yesterday's fresh highs, gold prices peaked within $4 per Troy ounce of $3900 before losing 1.8% in barely an hour to $3830.

Silver also reversed an overnight drop before topping $48 per Troy ounce for the first time since April 2011's retouch of silver's 1980 high at $50.

But silver prices also then sank, down 3.9% to erase all of this week's previous move at $46.10.

"From a market perspective, the most tangible impact is that we won't get the weekly jobless claims data today, or the jobs report tomorrow," says German financial giant Deutsche Bank.

"So private sector data releases are generating an outsize market impact as a result."

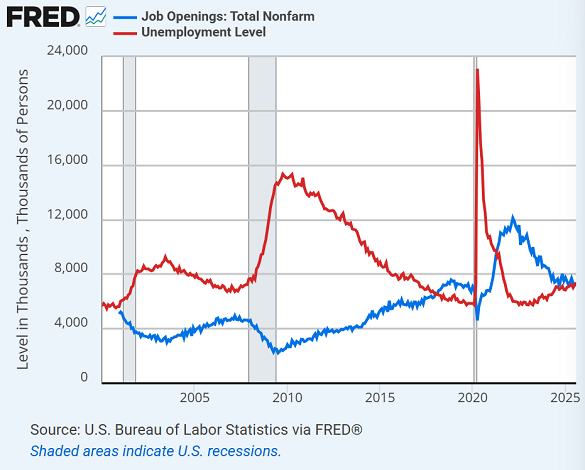

Ahead of the US government shutdown, the first since 2019 and coming after Democrat and Republican senators failed to agree a new funding program, August's 'Jolts' data from the Bureau of Labor Statistics put the number of unemployed US workers above the number of job openings for the first time since April 2021.

But that situation also persisted without break for nearly 17 years after the Jolts data was launched in 2001.

Despite non-essential services being shut, "Historically, the impact of shutdowns on GDP growth has been shortlived and contained, largely because essential government services continued to operate and resolutions were typically reached swiftly," says the latest weekly note from specialist bullion-market analysts Metals Focus.

"[But] even assuming a bipartisan resolution is reached in the near term, we maintain a constructive outlook for gold well into 2026."

Base metal copper, sometimes called Dr.Copper and the 'metal with a PhD' because of its price correlation with world economic growth, also rose again Thursday to reach 2-month highs amid news of falling output from major miners Chile and Indonesia.

But crude oil fell traded at 4-month lows ahead of this weekend's meeting of the Opec+ producer nation cartel, expected to announce higher output despite a global supply glut.

New figures from the Energy Information Administration − the only major government data agency still "able to operate for a period of time" without new funding appropriations − said yesterday that commercial inventories of crude oil rose faster than analysts forecast last week, suggesting weaker energy demand.

Global redundancy services firm Challenger, Gray & Christmas meantime said planned US job cuts dropped 37% last month from August, but still took year-to-date cuts to the highest since the Covid Crisis of 2020, while hiring plans have fallen to the lowest since the financial crisis recession of 2009.

With tomorrow's non-farm jobs report cancelled by the BLS − already hit by President Trump firing its Commissioner after reporting poor jobs growth in August − Wednesday's ADP Payrolls release for September showed the first monthly drop in US employment since December 2020, defying analyst forecasts for a small rise but also needing "a heavy grain of salt" because the estimate is "notoriously inaccurate" according to some analysts.

Yesterday's ISM manufacturing survey also reported job losses for that sector, with new orders falling once more after showing a small month-on-month rise only twice so far this year.

"Four aspects of the gold market stand out just now," says a trading note from Japanese conglomerate Mitsubishi's precious metals division.

"India's resilience: imports at a nine-month high plus domestic prices at only a modest discount. China's decline: domestic demand continues to soften. ETF inflows [particularly] Western gold ETFs...[and] Coin and bar demand: Western retail buying has surged after months of inertia."

Email us

Email us