Gold and Silver Rebound as US Moves to Stockpile Minerals, China Pushes Yuan as Reserve Currency

GOLD and SILVER extended yesterday's rebound on Tuesday, recovering almost half of their worst price crash since 1980 as base metals also rallied and the Dollar slipped after President Trump said the USA is going to build a strategic stockpile of 'critical minerals' for corporate use and China's President Xi said he wants to Yuan to become a global reserve currency.

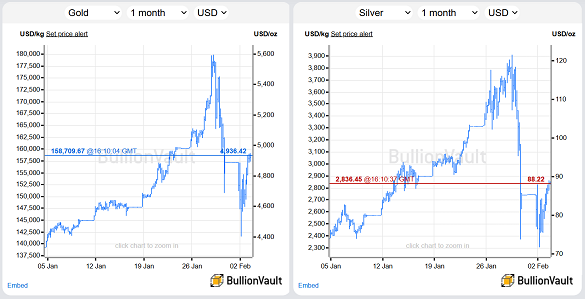

Trading back above $4900 per Troy ounce, gold reversed yesterday's $500 plunge but held almost $700 below last Thursday morning's fresh record spot-market gold high.

Silver rallied slightly less, rebounding by 11.0% to top $88 per Troy ounce but trading more than 1/4 beneath Thursday's fresh all-time high of $121.

The past week's precious metals plunge has been "a big [but] deserved correction" says bullion bank HSBC's precious metal analyst James Steel.

"Any market that has this parabolic rally, and the new entrants flooding into it, invites volatility, profit taking and liquidation on any news that runs counter" to the narrative driving it, says Steel.

"Silver's runaway rally becomes 'death trap' for Reddit's retail crowd," says a headline on the Financial Times website above a story quoting social-media posts from people who've lost money on leveraged derivatives bets alongside silver coin fans urging readers to "Keep on stacking."

"China gold traders suffer heavy losses," says Bloomberg, reporting how one "42-year-old homemaker in Hangzhou" turned 1 million CNY into ¥1.6m in 48 hours buying futures contracts before watching that evaporate to ¥250,000 amid last week's crash.

"I never imagined it could be this intense. It felt like a trip to a casino in Macau."

"We must uphold the centralized and unified leadership of the CPC Central Committee over financial work," said Communist Party chairman Xi Jinping in a speech last month, published today and repeatedly stressing the need for stability "to build a financial powerhouse.

"What constitutes a strong financial nation? It should be based on a strong economic foundation, possessing world-leading economic strength, technological prowess, and comprehensive national power...First, it should have a strong currency, widely used in international trade, investment, and foreign exchange markets, holding the status of a global reserve currency."

With a fortnight to go until Chinese New Year − typically peak gold buying season in the world's No.1 gold consumer nation − the Yuan has now gained 2.7% against the Dollar since China's Golden Week holidays in October, rising in 15 of the past 17 weeks.

The Dollar on Tuesday meantime tempered the past week's rally against major Western currencies, edging back on its DXY index after rallying 1.5% from last Tuesday's 4-year low.

Shanghai gold prices today flipped back to a premium above London quotes, offering new imports a gross incentive equal to $10 per ounce.

But silver prices in China edged back relative to London, cutting the premium from $15 per ounce to less than $9.

To be known as Project Vault, the US plan to build a reserve of critical minerals for corporate use will "ensure that American businesses and workers are never harmed by any shortage," said Trump overnight.

It will seek $2 billion of private capital alongside a $10bn loan from the US Export-Import Bank.

Email us

Email us