Gold Heads for Fresh Week-End Record But Silver's Price Chart 'Messy'

GOLD and SILVER CHARTS extended their rebound from multi-week lows Friday morning in London, reversing the last of their losses since wholesale trading in No.1 precious metals consumer China closed last weekend for the Lunar New Year holidays.

Gold prices fell to a discount this week versus London bullion rates for the first time since mid-January, showing a disincentive to new bullion inflows of $18 per Troy ounce after accounting for the sub-continent's import duty and GST sales tax according to Reuters.

Start-February's crash in global gold prices saw India's bullion market shoot to a $100 premium, the strongest Dollars-per-ounce incentive for new imports since mid-2014.

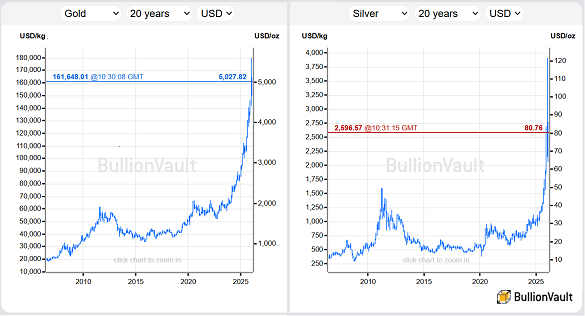

Back then, as the long-term charts show, global gold prices were trading around $1300 compared to $5025 today.

While the price of gold today traded $570 below late-January's record spot-market high of $5594 per Troy ounce, it held on track for a fresh week-end record in the London bullion market.

Any fix above $4990 at today's 3pm benchmark auction would mark London gold's 24th new all-time Friday high of the past 52 weeks.

Silver meantime made 11 new Friday records in 17 weeks between October and January, but the more industrially-useful precious metal then lost 27.4% over the following 5 trading days.

That was the steepest silver price crash since its lost 29.8% in the first week of May 2011, retreating from a re-touch of January 1980's all-time $50 spot market peak.

With silver today reclaiming the $80 level, "Technicals broken for some [precious metals, but] not all," says a note from strategist Nicky Shiels at Swiss bullion refining and finance group MKS Pamp.

"The 50-day moving average has been a respected (and simple) momentum support for gold and thus the sector for over a year. Gold overshot it by $900 in January, highlighting the short-term froth. [Yet] its equally stunning fall from grace still didn’t breach the 50dma.

"The same can’t be said about silver, whose chart is messier."

Given "10 to 15 days" meanwhile by US President Trump to make a "meaningful deal" over its nuclear development program, the theocratic dictatorship in Iran vowed overnight to respond "decisively" to any "military aggression" by the US Navy warships and aircraft now massing in the Persian Gulf and eastern Mediterranean.

With ceasefire talks between Russia and Ukraine breaking up this week with "progress" but no agreement, the Kremlin says it has pitched a "portfolio of potential US-Russia projects" worth $14 trillion, contingent on the end of Western financial sanctions imposed since Moscow's invasion of its neighbor began 4 years ago this weekend.

Email us

Email us