Gold, Silver and Platinum Plunge from Record Run as China Trading Shuts

PRECIOUS METALS prices sank on Tuesday in London, erasing this week's earlier jump for silver, platinum and palladium while halving gold's $120 spike to new record highs as bullion trading in China − the 'safe haven' investment's No.1 consumer and central-bank buyer − shut for the week-long National Day holidays.

Priced in Dollars, silver lost 2.8% after re-touching yesterday's fresh 14-year highs above $47 per Troy ounce, cutting the industrially-useful precious metal's year-to-date gain to 59.7%.

Fellow industrial precious metals platinum and palladium dropped twice as hard, plunging by more than 6.2% from Monday's new 12.5-year and 2-month highs respectively.

Gold meanwhile lost almost $80 per Troy ounce from a new London spot-market peak of $3871, set at 7am as trading on the Shanghai Gold Exchange closed until Thursday next week, before rallying back above the $3800 handle reached for the first time in history just yesterday.

Shanghai gold had also set a new all-time high in Tuesday's trading, fixing at ¥872 per gram with its 36th fresh record of 2025 so far.

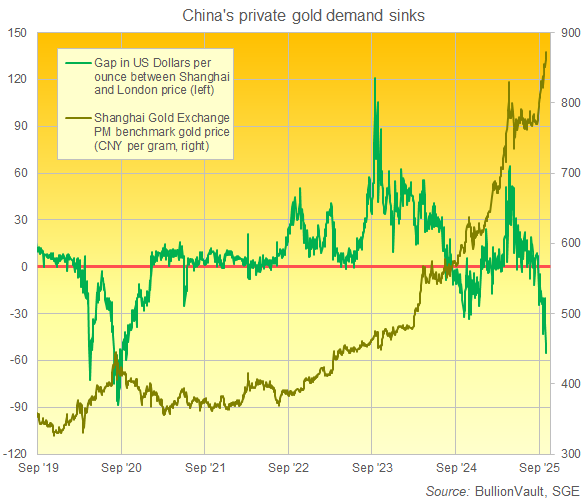

But that still left Shanghai gold at a deep discount to London prices − the deepest in almost exactly 5 years at $55 per ounce − reversing the more usual picture of a premium working to incentivize new bullion imports into China's private market.

That's still half the record Shanghai gold discounts seen when China's Communist government imposed strict Covid lockdowns as the pandemic took hold in 2020.

Yesterday's new all-time gold price highs spurred a rash of mainstream media coverage worldwide, with Bruce Ikemizu of the Japan Bullion Market Association saying he gave back-to-back interviews in Tokyo after retail gold prices in the world's 4th largest economy broke above ¥20,000 per gram.

That's a 10-fold rise from the level of the mid-2000s which triggered a run of net selling by Japanese investors who had first bought during the previous decade's Tokyo Crash and economic depression.

"There is no question that the rally of last week brought tourists onboard," agrees a trading note from giant Chinese bank and London bullion clearer ICBC, referring to the inflow of money into gold ETFs and other products from investors new to precious metals.

"[Today's] sell-off in precious kicked off in silver before spilling into gold. [And] it was natural for the unwinding to extend into the PGMs," ICBC says, adding that "the sell-off in precious complex [was] probably triggered by noisy month-end flows" on the final day of September.

Over in No.2 precious metals' consumer nation India, un-named government sources today told Reuters that imports of gold and silver bullion nearly doubled this month compared to August, "defying" record high Rupee prices as banks and dealers rushed to build stockpiles ahead of both next month's Diwali festival and a looming import-duty hike per kilo.

Contrary to China, gold prices in India have flipped to a premium this month, suggesting strong demand for this autumn's festive season and snapping a multi-year run of discounts versus London after the BJP-led Government rationalized differential rates and closed loopholes enabling 'grey' market inflows of gold bullion.

Gold bullion priced in UK Pounds and Euros also sank at the start of London trading on Tuesday, only to rally back to what were new all-time highs 24 hours earlier at £2845 and €3260 per Troy ounce.

Platinum's $100 plunge from Monday's 12.5-year peak of $1628 was also trimmed after lunch, but it left the autocatalyst metal lower for the week so far, cutting its 2025 gain-to-date to 71.4% at $1562.

"US gold reserves smash $1 trillion mark as precious metal hits fresh highs," noted US tabloid the New York Post on Monday, reporting how the "world's largest stockpile" is still officially booked at $42 per Troy ounce.

Shares in China's giant gold miner Zijin (SHA: 601899) leapt by 3/5th on yesterday's new listing in Hong Kong after recording the world's 2nd largest IPO of 2025 so far.

"China's Golden Week holiday starts on Oct. 1," noted precious metals strategist Nicky Shiels at Swiss bullion refiner and finance group MKS Pamp late Sunday, "with metals liquidity ([and central bank] buying programs?) impacted and eyes on consumption over the period."

The West Bank's Palestinian Authority meanwhile joined other regional Arab leaders on Tuesday in welcoming US President Trump's new 20-point peace plan for ending the war in Gaza. But Israel continued striking the Strip, reportedly killing 45 people today, while Hamas failed to respond to Trump's proposals.

Email us

Email us