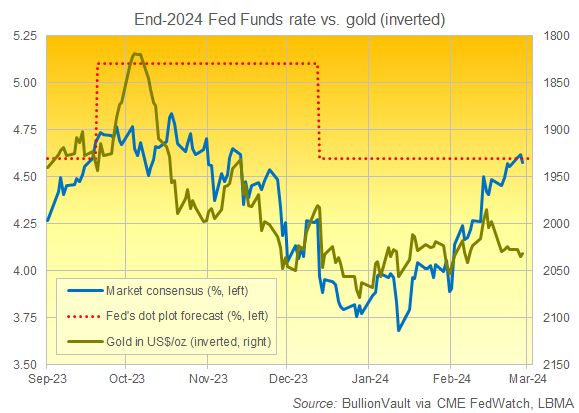

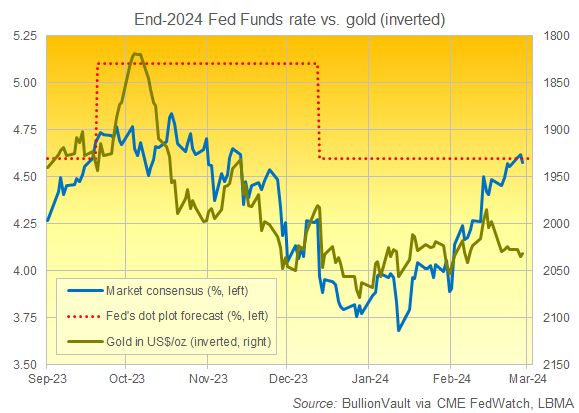

Gold Price Trading Dead-Flat, Stock Market Volatility Also Missing as US Fed Wins 'PR Drive' on Interest Rates

Please Note: All articles published here are to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. Please review our Terms & Conditions for accessing Gold News.